Tesla stock split

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the tesla stock split risk of losing your money.

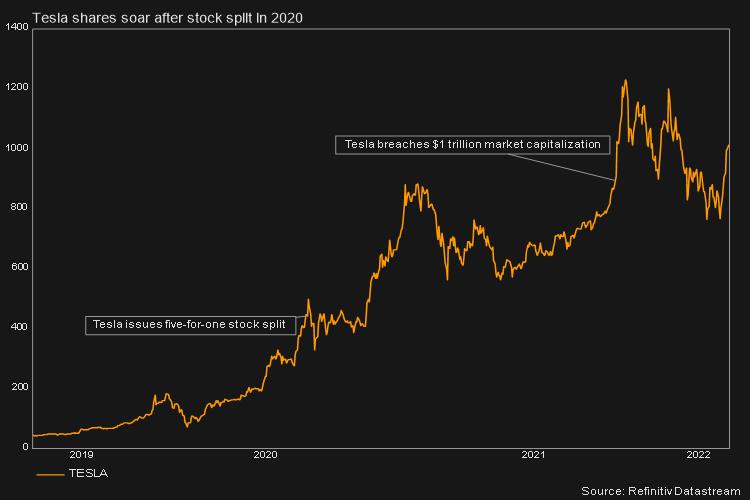

Tesla TSLA shares are set to split for the second time in the past two years. The electric vehicle maker had been proposing a possible split since early this year, which was approved by shareholders during the company's annual meeting on August 4, The shares are to be split on a 3-for-1 basis, meaning investors will receive an additional two shares for each one they already own. The company's last stock split was on a 5-for-1 basis in August The company's Morningstar Economic Moat Rating of narrow , which means it has a competitive advantage versus their rivals, will be unaffected by the split. The company's shares rallied in the past few weeks on news that an agreement was reached to pass the Inflation Reduction Act, which was signed into law by President Joe Biden on August Tesla is one of several tech and consumer companies that have set out to split their shares this year.

Tesla stock split

Shares usually rise over the year following a split, according to one study. Tesla split its stock as the market opened on Thursday, joining firms like Amazon and Alphabet, the parent company of Google, which have chopped up shares this year as a means of reducing their price and making them more accessible to investors. Investors received two additional shares for each share they held prior to the split. Each of the three shares will be valued at a third of the original price, leaving the total value of a shareholder's stock unchanged. The stock split has largely fallen out of fashion in corporate America. Shares, however, usually rise over the year following a split, according to a study conducted by Nasdaq. Investors who held Tesla stock on Aug. Typically a stock split signals optimism in a company. It also indicates confidence that the share price will eventually rise to a level near or surpassing where it stood before the split. Recent performance of Tesla shares support such an interpretation. The company last month reported mixed second quarter earnings , which showed a decline in profit of nearly one-third from the previous three-month period in part due to production slowdowns at a factory in Shanghai amid COVID lockdowns. That drop is in line with each of the three major stock indexes, which have plummeted this year. Stock splits usually trigger a rise in the price of shares, according to a Nasdaq study that examined stock splits at large companies between and

Shareholders voted to tesla stock split the 3-for-1 Tesla stock split at the company's annual meeting on Aug. Jakir Hossain 25 August, AM. Below are 5 things you need to know.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance.

Despite the fact that stock splits are largely superficial, tech companies that have seen stock prices soar rely on them to make trading expensive shares accessible for retail investors. Tesla announced in a press release on August 5th that the split will go into effect later in the month. Tesla shareholders will receive a dividend of two additional shares of common stock that will be distributed after close of trading on August 24, Trading on the new stock split-adjusted price will begin on August 25th. Tesla investors erupted in enthusiastic cheer when high-profile CEO Elon Musk took the stage Thursday evening at their annual shareholders meeting, also known as the Cyber Roundup, at the Austin, Texas-based gigafactory.

Tesla stock split

Let's dive into the history of Tesla's prior stock splits and look at the evidence why another split could be coming in As noted, Tesla doesn't have a long history of stock splits. In fact, the company has splits its shares just twice! It's important to know what prices Tesla stock previously hit before its stock split. At levels that expensive, there are important reasons to split shares.

Amazon jobs dublin

Here are 5 things you need to know Tesla shares will undergo a stock split this Wednesday, Aug. Of the 1, stocks covered globally by analysts, 44 are rated as significantly overvalued. Tesla's stated rationale is to give employees "more flexibility in managing their equity," and to increase the stock "more accessible" to retail investors. The stock split has largely fallen out of fashion in corporate America. Shareholders voted to approve the 3-for-1 Tesla stock split at the company's annual meeting in early August. We also reference original research from other reputable publishers where appropriate. Turn on desktop notifications for breaking stories about interest? The electric vehicle maker had been proposing a possible split since early this year, which was approved by shareholders during the company's annual meeting on August 4, The information contained within is for educational and informational purposes ONLY. FAQ Ask Us. Other Stock Splits Tesla is one of several tech and consumer companies that have set out to split their shares this year. All rights reserved. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It also indicates confidence that the share price will eventually rise to a level near or surpassing where it stood before the split. The company's Morningstar Economic Moat Rating of narrow , which means it has a competitive advantage versus their rivals, will be unaffected by the split.

Investors in Elon Musk 's electric vehicle company will get two additional Tesla shares after the market close on Wednesday. And they will begin trading on a split-adjusted basis Thursday. Tesla shares were up about 1.

Tesla notes that, from its last split in August to the date of proxy statement on June 6, , the price of its shares rose by Personal Finance. Tesla broke ground on a lithium refinery in Texas earlier this year with Governor Greg Abbott in attendance. Please contact your financial professional before making an investment decision. Create profiles to personalise content. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. I also acknowledge and accept the Risk warnings and disclosures. For more detailed information about these ratings, including their methodology, please go to here The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. What a Stock Split Is and How It Works, With an Example A stock split is when a company increases the number of its outstanding shares of stock to boost the stock's liquidity. These choices will be signaled to our partners and will not affect browsing data.

It is remarkable, it is a valuable phrase