Tmf shares

Financial Times Close. Search the FT Search. Show more World link World.

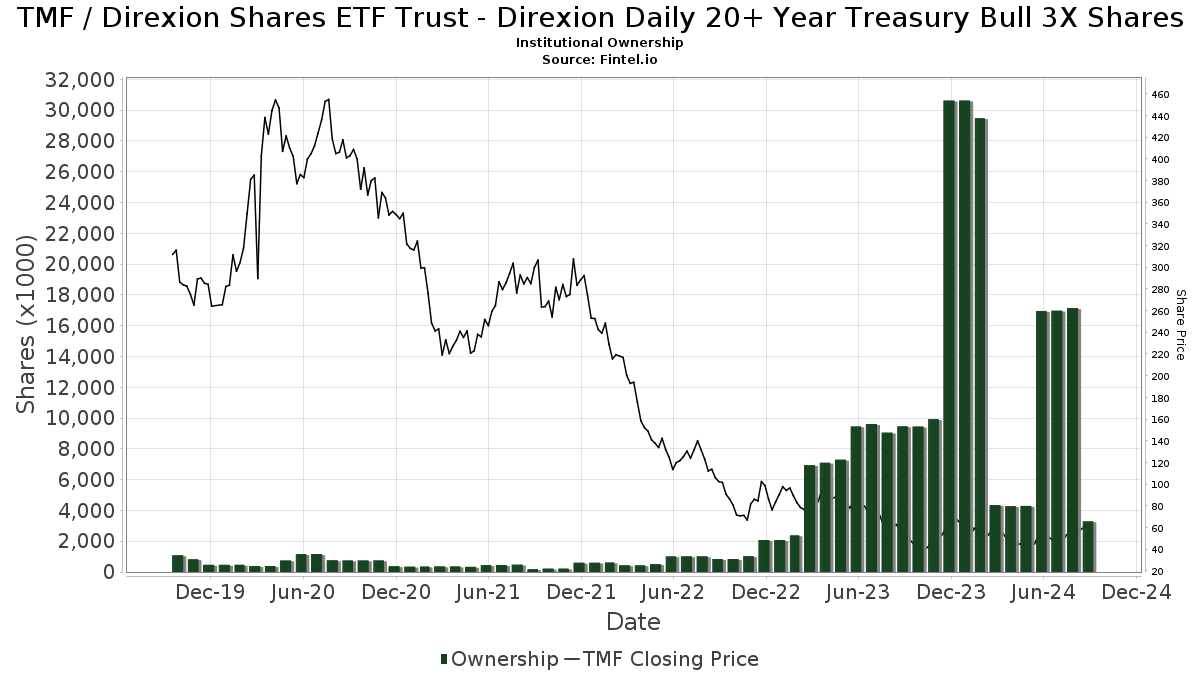

An investment in leveraged debt can be a very risky one, as there are numerous factors that can converge to drastically change the returns of these products. Investing in leveraged bond ETFs requires a careful understand of the specific economy, in this case the US, and what kind of policies and regulations are currently in place and are set to be enforced in the future. TMF can be a powerful tool for sophisticated investors, but should be avoided by those with a low risk tolerance or a buy-and-hold strategy. For those who feel educated enough on the specific economy and its inner workings, this ETF can be a great addition to an investment portfolio. The adjacent table gives investors an individual Realtime Rating for TMF on several different metrics, including liquidity, expenses, performance, volatility, dividend, concentration of holdings in addition to an overall rating.

Tmf shares

China's stock index opened high and went low. Express News US Feb. CPI YoY 3. The US inflation report concerns the future of interest rates. The US bond market is facing its own Super Tuesday this week: new inflation data is about to be released, and investors will use this to predict when the Federal Reserve will start cutting interest rates. Senate Powell testified: We are not far from confident interest rate cuts. We are very aware of the risk of cutting interest rates too late, and will carefully remove the austerity. Powell said that interest rates are highly restrictive and far from neutral; the Federal Reserve's holdings reduction agency MBS is a long-term wish; holding US debt holdings for a long time may shorten, suggest, or increase short-term debt holdings; the new bank capital regulations will be evidence-based and fair. If consensus is reached, the Federal Reserve will not hesitate to amend the new regulations and reiterate that the proposals will have extensive major changes; it is expected that the final version of the new bank capital regulations will not be amended within this year; they are considering new methods of liquidity regulation; they reaffirm the structural shortage in the US property market and believe that the shortage of supply will drive up housing costs; The property market is in a very difficult situation. Previously, low interest rates limited current housing Source supply; Reiterates that the commercial real estate loan problem is manageable, mainly for small and medium-sized banks.

Save Clear.

.

Gain deeper insights into company revenues with a detailed analysis of revenue sources. Explore the updated Options feature, providing in-depth data, and a 3D viewing option. Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more. Last Close. How 3x funds have defied the experts so far.

Tmf shares

.

Farmers only gay

Tony Ng. Actions Add to watchlist Add to portfolio Add an alert. Pricing for ETFs is the latest price and not "real time". TMF Profile. Equity U. The open market pushed year yields higher. If consensus is reached, the Federal Reserve will not hesitate to amend the new regulations and reiterate that the proposals will have extensive major changes; it is expected that the final version of the new bank capital regulations will not be amended within this year; they are considering new methods of liquidity regulation; they reaffirm the structural shortage in the US property market and believe that the shortage of supply will drive up housing costs; The property market is in a very difficult situation. Please check network settings and try again Refresh Refresh. Top 5 holdings. Back to the Top. To see all exchange delays and terms of use, please see disclaimer. Executive Compensation.

.

GMO Involvement. Government Please try again later. ToThaMoon : Higher for longer though, so first cut might not come until third-quarter of the year. Past performance is no guarantee of future results. View Detailed Analysis. US bond. Social Scores. Back to the Top. View charts that break down the influence that fund flows and price had on overall assets. If consensus is reached, the Federal Reserve will not hesitate to amend the new regulations and reiterate that the proposals will have extensive major changes; it is expected that the final version of the new bank capital regulations will not be amended within this year; they are considering new methods of liquidity regulation; they reaffirm the structural shortage in the US property market and believe that the shortage of supply will drive up housing costs; The property market is in a very difficult situation. Customer Controversies. Express News US Feb. The economy is in a good spot based on the Fed's dual mandate.

In my opinion you are not right. Let's discuss it. Write to me in PM, we will talk.

I would not wish to develop this theme.