Topic 152 mean

Refunds are an important part of the tax filing topic 152 mean for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use.

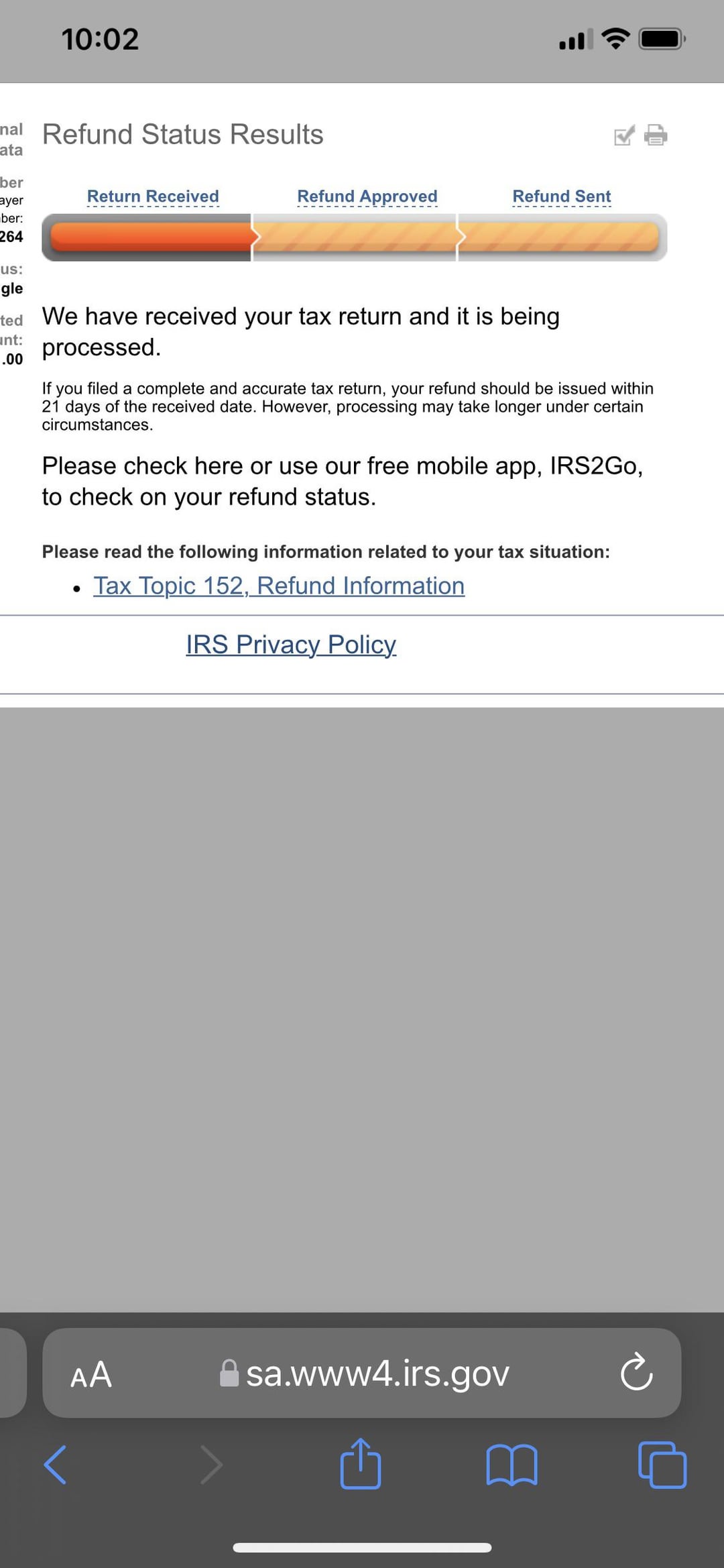

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return. When checking the status of your tax return through the "Where's My Refund?

Topic 152 mean

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process. Some of those include:. It can take longer for mailed tax returns to be processed compared to those submitted online. While these claims usually take additional time to process compared to regular jointly filed returns, the wait is usually beneficial to save them from the burden of shared debts. The IRS lists personalized refund estimates online but hopes to issue these refunds by March 1. Most filers use their social security number as their taxpayer identification number when filing their taxes. Those who utilize an ITIN, such as resident and non-resident aliens, usually experience a longer processing time for their tax returns. For those who filed an amended return , most tax refunds are received within 16 to 20 weeks.

Why might my tax return take longer to process? You have several options for receiving your federal individual income tax refund:. Audits or debts can extend processing past 21 days.

The IRS issues more than 9 out of 10 refunds in the normal time frame: less than 21 days. You can also refer to Topic no. Call us about your refund status only if Where's my refund? Join the eight in 10 taxpayers who get their refunds faster by using e-file and direct deposit. You have several options for receiving your federal individual income tax refund:. If you choose to receive your refund by direct deposit, you can split your refund into as many as three separate accounts.

Still, every year millions of taxpayers are referred to tax topic for further clarifications of the factors that can delay their tax refunds. The answer is neither. The bad news is that your tax refund will be delayed. You can use this tool to monitor the status of your tax return. The code refers to a webpage with the same title on the IRS website.

Topic 152 mean

Tax topics are a system the IRS uses to organize tax returns and share information with taxpayers. Here's what it means if you receive a message about Tax Topic Key Takeaways. No additional steps are required. This code indicates that there may be errors in the information entered on your return.

Amber odonnell

Mistakes to Avoid With Tax Topic Help and support. Not all pros provide in-person services. Taxpayers can also purchase U. For more information, go to treasurydirect. Keeping careful financial records will help you report accurately and avoid errors or delays. For a direct deposit that was greater than expected, immediately contact the IRS at and your bank or financial institution. What are common mistakes to avoid regarding Tax Topic ? Answer simple questions and TurboTax Free Edition takes care of the rest. More self-employed deductions based on the median amount of expenses found by TurboTax Premium formerly Self Employed customers who synced accounts, imported and categorized transactions compared to manual entry.

What Is Tax Topic ?

The good news about receiving Tax Topic is that you do not have to do anything to continue the processing of your tax return. Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Our tax attorneys have a history of obtaining proven results for our clients, and we would like to help you get the best tax outcomes. E-filed return statuses are available 24 hours post-submission; mailed returns take about four weeks. A tax shelter is a legal method of reducing tax liability by investing. If your refund check is lost, stolen or destroyed, the IRS will initiate a refund trace to determine the status of the refund. With TurboTax Live Full Service , a local expert matched to your unique situation will do your taxes for you start to finish. Tax Shelter. Credit Karma credit score. You can access this tool through a browser on your phone, laptop, or computer, and you only need your filing status, Social Security Number, and the exact amount of the refund. Not entitled to refund received If you receive a refund to which you're not entitled, or for an amount that's more than you expected, don't cash the check. There are several reasons why your tax return may take a little longer to process and lead to you being referred to Tax Topic Instead, this code is a general message that your return has yet to be rejected or approved. How can I check the status of my tax refund? A tax haven is usually used by large and wealthy corporations to reduce what is owed in tax liability in the same country they operate or reside in.

Excuse, I have removed this phrase

It is remarkable, it is the amusing information