Tradingview rsi strategy

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Tradingview rsi strategy to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart, tradingview rsi strategy.

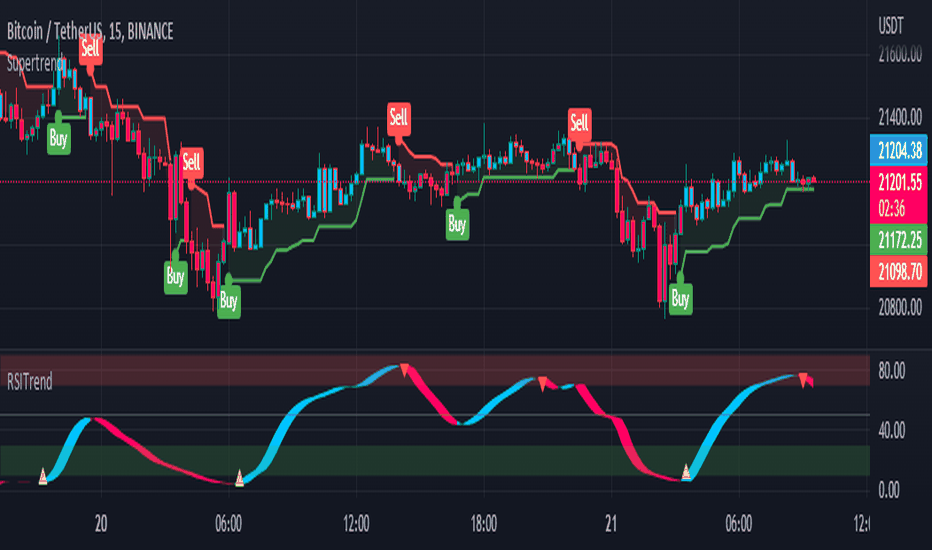

Questions such as "why does the price continue to decline even during an oversold period? These types of movements are due to the market still trending and traditional RSI can not tell traders this. It is designed to provide a highly customizable method of trend analysis, enabling investors to analyze potential entry and exit points The intelligent accumulator is a proof of concept strategy. A hybrid between a recurring buy and TA-based entries and exits. Distribute the amount of equity and add to your position as long as the TA condition is valid. Use the exit TA condition to define your exit strategy.

Tradingview rsi strategy

Intro: This is an example if anyone needs a push to get started with making strategies in pine script. This is an example on BTC, obviously it isn't a good strategy, and I wouldn't share my own good strategies because of alpha decay. This strategy integrates several technical indicators to determine market trends and potential trade setups. These indicators This strategy, which I've honed through my years of experience in the trading arena, stands out The nRSI stands as a groundbreaking enhancement of the traditional Relative Strength Index RSI , specifically engineered for traders seeking a more refined and accurate tool in fast-moving markets. This indicator is designed to display various technical indicators, candle patterns, and trend directions on a price chart. Let's break down the code and explain its different sections: Exponential Moving Averages EMA : The code calculates and plots five EMAs of different lengths 13, 21, 55, 90, and on the price chart. These EMAs are used to identify This indicator combines the Relative Strength Index RSI with a Volume Oscillator to provide valuable insights into momentum and volume dynamics in the Arrows are a visual way to identify trading opportunities and can be useful for traders

Works well on other timeframes as well. Monitor the chart for trade signals generated by the strategy.

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in a publication is governed by House Rules. You can favorite it to use it on a chart. The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

This strategy only triggers when both the RSI and the Bollinger Bands indicators are at the same time in the described overbought or oversold condition. In addition there are color alerts which can be deactivated. This basic strategy is based upon the "RSI Strategy" and "Bollinger Bands Strategy" which were created by Tradingview and uses no money management like a trailing stop loss and no scalping methods. This strategy does not use close prices from higher-time frame and should not repaint after the current candle has closed. It might repaint like every Tradingview indicator while the current candle hasn't closed. All trading involves high risk; past performance is not necessarily indicative of future results. Hypothetical or simulated performance results have certain inherent limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not actually been executed, the results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight.

Tradingview rsi strategy

You can use various indicators in TradingView to create the right trading strategy for intraday or positional-based long-term investment. There are various technical indicators but you can use the best indicators in TradingView that are most popular and effective in terms of giving the right signal. RSI is one of the best indicators in TradingView. Today we are going to discuss how to add, use, and rest RSI indicators with the right strategy in TradingView. Relative Strength Index RSI is one of the best momentum-based oscillators used to measure the speed velocity as well as the change magnitude of directional price movements in the stock or market index. Along with giving the visual strength and weakness of the market, it also shows whether the stock price or market index is trading in an overbought or oversold zone. Formula and Strategy.

Crazy quilt solitaire

There is a time stop of five days if the sell criterium is not These indicators Unlike an actual performance record, simulated results do not represent actual trading. The relative strength index RSI is a momentum indicator used in technical analysis to evaluate overvalued or undervalued conditions in the price of that security. Indicators, Strategies and Libraries. RSI Trend. Related reading: Free TradingView trading strategies. For free users, the Export data option is not available. TrendColor:na bgcolor switch2? To solve this inconvenience, we recommend checking out a post by QuantNomad that provides a solution for analyzing our data in an Excel spreadsheet. While this strategy is as old as modern financial markets, not many know what it is…. This indicator is helpful as it confirms when a trader should enter a position or exit based on the Be sure to enter slippage and commission into the properties to give you realistic results. Finally there's custom alert fields so you can send custom alert messages for strategy entry and exit for use with automated trading services. DMO is different from classic

.

Please note that trading decisions should be made based on a comprehensive analysis of multiple factors, including market conditions, trend analysis, and risk management. This strategy creator allows you to turn on or off these indicators and adjust the parameters for each indicator. The Bollinger Bands are among the most famous and widely used indicators. Finally there's custom alert fields so you can send custom alert messages for strategy entry and exit for use with automated trading services. Unlike an actual performance record, simulated results do not represent actual trading. The RSI is calculated using a mathematical formula that compares the magnitude of upward and downward movements over a specific period of time. Williams Percent Range with Trendlines and Breakouts. To specify a time from use the format or whatever your trading hours will be. You can favorite it to use it on a chart. With this, along with the extensive content from Quantified Strategies on how to analyze strategies, you should have robust tools to make informed decisions about your systems and strategies.

You are not right. I can prove it. Write to me in PM, we will communicate.

This amusing message