Tukwila sales tax

Sales Sales tax rates are determined by exact street address.

Sales King County Tax jurisdiction breakdown for Sales tax rates are determined by exact street address. The jurisdiction-specific rates shown add up to your minimum combined sales tax rate. The total rate for your specific address could be more. The minimum combined sales tax rate for King County, Washington is.

Tukwila sales tax

The City of Tukwila places a tax on admissions, gambling, utilities, and commercial parking. Tax return forms must be signed and submitted to the Finance Department. Tax returns cannot be filed or paid online. Payment via check or money order must be received or postmarked by the tax return due date to avoid penalties and interest. Returns and payment should be mailed to:. General information regarding each type of tax is below. Persons engaging in business in Tukwila must also maintain a city business license. If you have questions, please contact the Finance Department at tax tukwilawa. The first returns for Quarter 1 are due by April 30, Tax is not due for Business and Occupation tax return non-fillable. See TMC Chapters 3. Admissions Tax Admissions tax return Admissions tax is collected when there is a charge for admission to a place or event for recreation or entertainment within city limits. See TMC Chapter 3. Gambling Tax Gambling tax return The gambling tax applies to businesses or organizations conducting gambling activities within city limits.

State business licenses Licensing requirements by location.

Download all Washington sales tax rates by zip code. The Tukwila, Washington sales tax is The local sales tax consists of a 3. In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. Tukwila doesn't collect sales tax on purchases of most groceries. Prepared Food is subject to special sales tax rates under Washington law.

The City of Tukwila places a tax on admissions, gambling, utilities, and commercial parking. Tax return forms must be signed and submitted to the Finance Department. Tax returns cannot be filed or paid online. Payment via check or money order must be received or postmarked by the tax return due date to avoid penalties and interest. Returns and payment should be mailed to:. General information regarding each type of tax is below.

Tukwila sales tax

Download all Washington sales tax rates by zip code. The Tukwila, Washington sales tax is The local sales tax consists of a 3. In most states, essential purchases like medicine and groceries are exempted from the sales tax or eligible for a lower sales tax rate. Tukwila doesn't collect sales tax on purchases of most groceries. Prepared Food is subject to special sales tax rates under Washington law. Certain purchases, including alcohol, cigarettes, and gasoline, may be subject to additional Washington state excise taxes in addition to the sales tax.

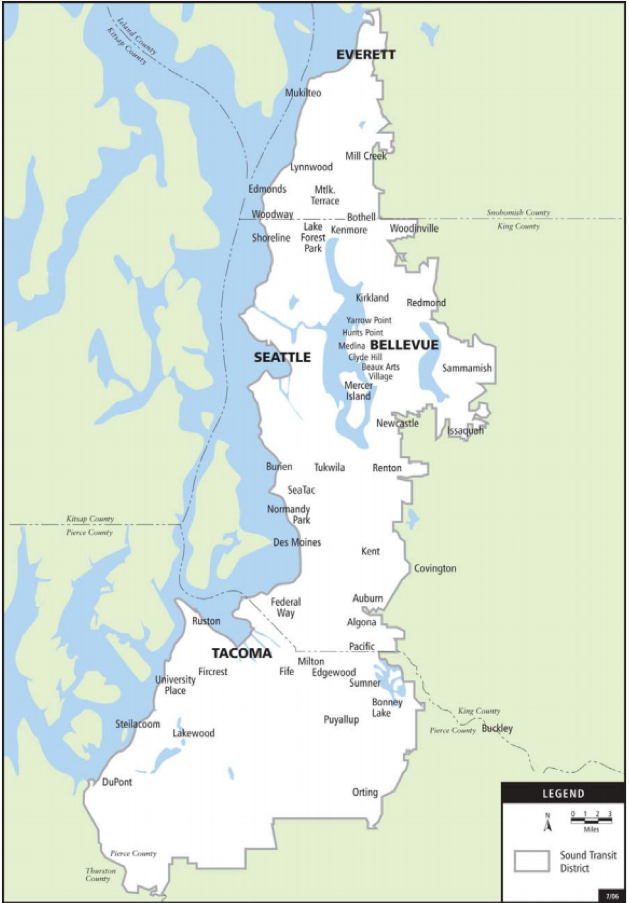

The living years youtube

Tax types. The Tukwila sales tax region partially or fully covers 7 zip codes in Washington. Commercial parking taxes paid more than 15 days after the due date are subject to a penalty of 10 percent of the tax due per month. Avalara Exemption Certificate Management Collect, store, and manage documents. State business licenses Licensing requirements by location. Events Join us virtually or in person at Avalara events and conferences hosted by industry leaders. ZIP codes associated with tukwila. Direct sales Tax compliance products for direct sales, relationship marketing, and MLM companies. You can find sales taxes by zip code in Washington here. See TMC Chapter 3. Why automate. Download all Washington sales tax rates by zip code. Streamlined Sales Tax program.

We've added new features that provide more detailed search results and organize your saved information for effortless filing. The updated app is available for both IOS and Android.

Enterprise solution An omnichannel, international tax solution that works with existing business systems. Supply chain and logistics Tariff code classification for cross-border shipments. Marketplaces Products to help marketplace platforms keep up with evolving tax laws. Download all Washington sales tax rates by zip code. Prepared Food is subject to special sales tax rates under Washington law. If you notice that any of our provided data is incorrect or out of date, please notify us and include links to your data sources preferably local government documents or websites. Please ensure that your city business license endorsement reflects your current mailing address, so that you receive any mailed notices from the city regarding the tax. Browse integrations. Go To Top ». Definitions for the following tax categories are provided in TMC 3. Free economic nexus assessment Find out where you may have sales tax obligations Tool. Energy Tax compliance for energy producers, distributors, traders, and retailers.

In it something is. Many thanks for the information. It is very glad.

I am final, I am sorry, but you could not give more information.