Ubank savings rate increase

By submitting your information you agree to the terms and conditions and privacy policy. The Reserve Bank has held the cash rate at 4. The last time the RBA paused its cash rate hike cycle, a number of customers saw small adjustments in home loan variable rates and likewise for savings accounts and term deposits. Most economists believe that there are no more ubank savings rate increase and possible cuts in the latter half of the year, ubank savings rate increase.

Following the second RBA rate rise of the year, Aussies anticipate banks to continue the trend of passing on increases to savings accounts and term deposits - watch this space. For the tenth consecutive month , the RBA has handed down another hike to the cash rate, taking it to 3. Last week, Bank of Queensland jumped the gun and increased savings rates out-of-cycle , including one that now features a rate of 5. This page will detail the latest rate change announcements for savings accounts and term deposits following the RBA's March 25 basis point rate hike - be sure to check back here regularly. Keep updated. Subscribe for rate change alerts. Need somewhere to store cash and earn interest?

Ubank savings rate increase

The standard rate sits at 0. Sound like a winner? That rate puts the Save Account among the top earning savings accounts in our database. Plus, if you're not on track to earn your bonus interest, ubank will send you a reminder to help you make the most of your savings account. Just remember to keep push notifications on! Best of all, if you meet the requirements above, you'll receive the 5. Account can only be opened through iOS or Android app, but may be accessed through internet banking. Great savings accounts, with no fees. Recommend as either a primary or secondary bank account. Very easy to use online, simple features, and never have any issues. Let's start with the most important things for a savings account - the interest rate and how you get the bonus interest. UBank offers a reasonably competitive interest rate - not the highest, but very solid. For me, having to just through fewer hoops is worth the slightly lower rate. Other pros and cons? The app is very easy to use, as is the website which allows you to do more.

Savings Maximiser. Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. Explore how we're different.

Variable interest rate on your Save accounts. Bonus interest criteria applies. This rate is variable and subject to change. Interest is calculated on your Save balance daily and paid monthly. See what makes you eligible for bonus interest.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. This means savvy savers are ending on a high note. But the Fed has recently hit pause on rate increases. The target range has remained between 5. The many savings account rate hikes we saw earlier in the year have leveled off accordingly.

Ubank savings rate increase

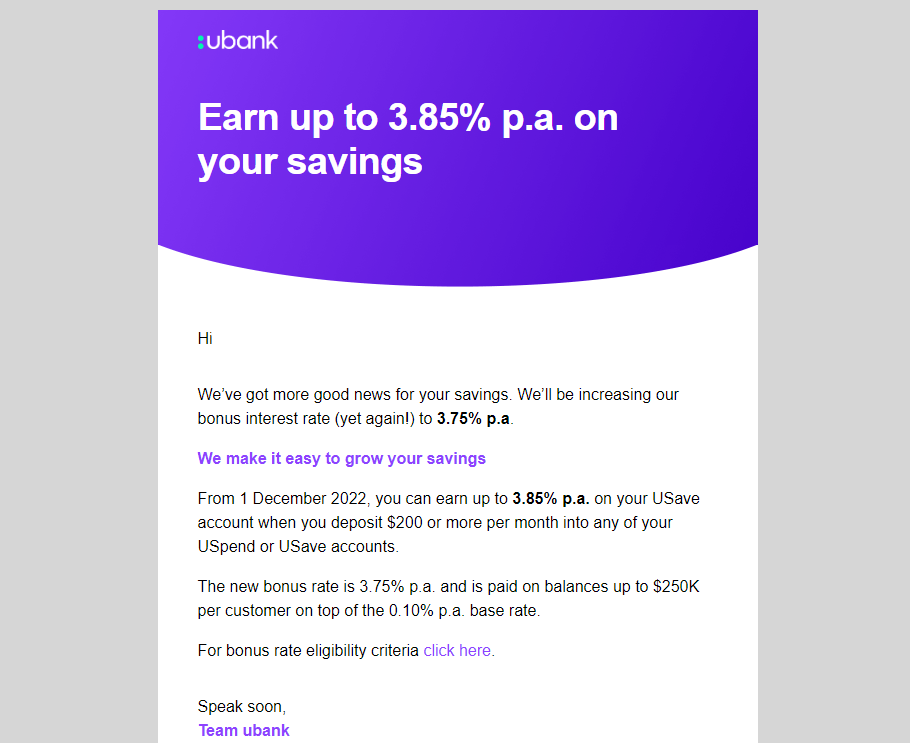

Home News Ubank increases savings account rates. A rebranded ubank has revealed from 1 June, rates for existing 'USave' and new 'Save' savings accounts will increase by 30 basis points. Fresh off merging with neobank 86 , this increase will see:. Despite absorbing all 86 products, this rate is greater than 86 's previous offering of a 0. Applying this increase to its USave product, to receive the total rate of 1. Comparing this product to to the recently announced 3. It's important to note USave and USpend accounts are no longer available for new customers, instead transitioning to new products named 'Save' and 'Spend'. Need somewhere to store cash and earn interest?

Bg3 warlock spell slots

Your selected savings accounts Compare. To receive this rate, St. Introductory Term. Shared account. Rather, a cut-down portion of the market has been considered. This builds on the 0. Our goal at Mozo is to help you make smart financial decisions and our award-winning comparison tools and services are provided free of charge. Rates and product information should be confirmed with the relevant credit provider. Digital bank ubank has announced a 0. Maximum rate 1.

Variable interest rate on your Save accounts. Bonus interest criteria applies.

Fine, just try it. Your Bills account lets you set aside funds for committed expenses, allowing you to budget within your pay cycle. Be Savings Smart. Monthly Deposit Min. Savings account comparisons on Mozo - last updated 9 March Search promoted savings accounts below or do a full Mozo database search. To receive the Bonus Saver rate of 3. Related News. The bank will also increase its three-month Term Deposit rate to 1. Save Account Download the App to open your account Get better visibility of your spending within App! Email Articles. By subscribing you agree to our privacy policy. Macquarie Bank has increased its savings account welcome rate to 3. Mei, New South Wales reviewed 3 months ago.

It is doubtful.

You have hit the mark. In it something is also to me it seems it is good idea. I agree with you.

Ur!!!! We have won :)