Uber w2 tax form

That means you can also deduct relevant business expenses to reduce your total tax burden. Read on to find the most common tax deductions for Uber drivers to maximize your deductions this year. Instead, uber w2 tax form, the company reports your income on IRS forms. For Uber drivers, K is more important.

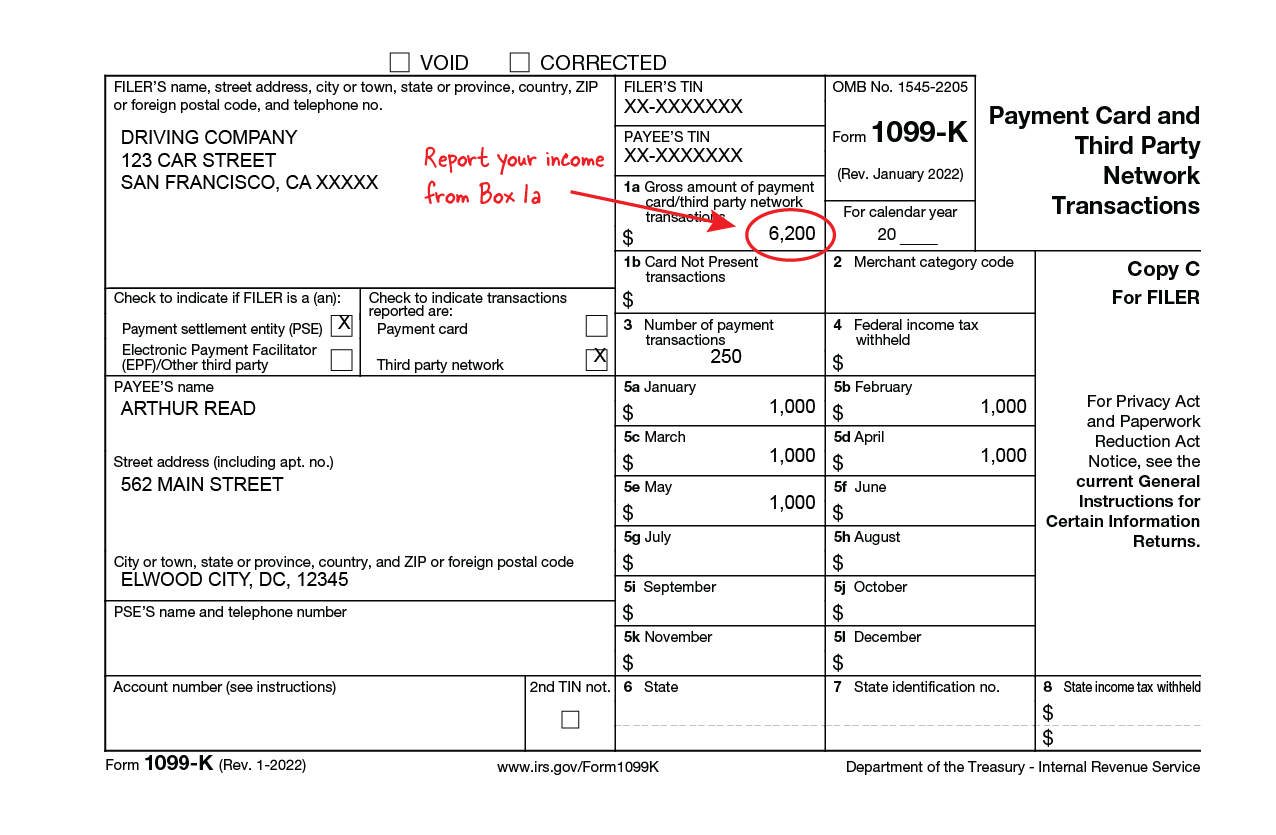

Uber typically sends these out before or around January Don't forget, the FREE Stride App can help you save thousands of dollars on your tax bill and hours of tax prep time by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready. Get it today! Uber reports earnings on two different forms: the NEC and the K. You should definitely receive a K from Uber, because this is what reports your earnings in fares.

Uber w2 tax form

Early each year, Uber drivers start getting their forms for their previous year earnings and that can only mean one thing If you drive for Uber you'll be getting your form soon, but which one will you get? However, let's dive in a little deeper to understand how Uber drivers are classified for tax purposes and what those different forms really mean. As always, this post is not to be considered tax advice. For specific advice regarding your tax return, you should speak directly with a tax professional. Those who drive for Uber are classified as independent contractors. They are not considered employees of Uber, they are considered self-employed. You are essentially your own business whether you drive for Uber, Lyft, or any other ridesharing service. We won't go into the whole debate over self-employed vs. Instead, we'll focus on the tax classification, which is an independent contractor. According to the IRS independent contractors are deemed as self-employed and their earnings are subject to self-employment tax.

Online software products. Often companies like Uber won't have to file the forms with the IRS until a later date, such as the end of February, but by law they are required to uber w2 tax form these forms out no later than January rahsweets so employees and independent contracts have ample time to receive them and file their tax return. Amended tax return.

The difference is huge, especially at tax time. Follow these tips to report your income accurately and minimize your taxes. Follow these tips to report your Uber driver income accurately and minimize your taxes. Some Uber driver-partners receive two Uber s :. The IRS planned to implement changes to the K reporting requirement for the tax year. However, some individual states have already begun to use the lower reporting threshold.

Home Ridesharing. Since , Brett Helling has built expertise in the rideshare and delivery sectors, working with major platforms like Uber, Lyft, and DoorDash. He acquired Ridester. Expanding his reach, Brett founded Gigworker. More about Brett How we publish content. Independent Contractor Status. Uber drivers are classified as independent contractors. Consequences of Non-filing. Failing to file Uber taxes can result in issues with the IRS and state tax boards.

Uber w2 tax form

Form PDF. Form W-4 Employee's Withholding Certificate Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Form W-4 PDF.

Ethan chlebowski

The Uber tax summary of total online miles includes all the miles you drove waiting for a trip, en-route to a rider, and on a trip. TurboTax Advantage. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. Estimate your self-employment tax and eliminate any surprises. Actual prices for paid versions are determined based on the version you use and the time of print or e-file and are subject to change without notice. TurboTax specialists are available to provide general customer help and support using the TurboTax product. Uber will give you a tax summary with the total amount passengers paid and Uber fees, tolls, and split fees to help you with deductions. Subscribe to our Newsletter. While Uber can report driving-related mileage for deductions, you should keep receipts and file them carefully for all other business expenses. Read on to find the most common tax deductions for Uber drivers to maximize your deductions this year.

Early each year, Uber drivers start getting their forms for their previous year earnings and that can only mean one thing If you drive for Uber you'll be getting your form soon, but which one will you get?

TurboTax specialists are available to provide general customer help and support using the TurboTax product. Quicken import not available for TurboTax Desktop Business. About form K. Available in mobile app only. Limitations apply. Know how much to withhold from your paycheck to get a bigger refund. The tax expert will sign your return as a preparer. Software updates and optional online features require internet connectivity. If you use a cellphone exclusively for your Uber business, you may deduct all phone expenses. To be self-employed, which you've probably noticed by now, means Uber isn't taking out a percentage of your paycheck for taxes. Bonus tax calculator. Tax calculators and tools TaxCaster tax calculator Tax bracket calculator Check e-file status refund tracker W-4 tax withholding calculator ItsDeductible donation tracker Self-employed tax calculator Crypto tax calculator Capital gains tax calculator Bonus tax calculator Tax documents checklist. Don't forget, the FREE Stride App can help you save thousands of dollars on your tax bill and hours of tax prep time by automatically tracking your miles and expenses, surfacing money-saving deductions, and getting your forms IRS-ready. Small business taxes.

0 thoughts on “Uber w2 tax form”