Vancity e transfer limit

Put aside funds you'll have access to anytime, with competitive interest, no monthly account fee, and deposits that support positive change in your community. Repay or refinance your CEBA loan by vancity e transfer limit upcoming deadline and you may qualify for partial forgiveness. Pay expenses, employees, suppliers quickly, 24 hours a day, 7 days a week. Use the Request Money feature to send invoice numbers, personalized messages and due dates along with your payment request.

A bonus for you and the planet. Offer ends March 31, Conditions apply. No more rushing to the ATM in search of cash or depositing cheques at the branch. All this, without having to share your bank details with anyone. Send money to anyone with an online banking account in Canada.

Vancity e transfer limit

Learn more about how Interac e-Transfer answers the need of Canadian enterprises. Transaction history is available to keep track of past payments. Interac e-Transfer Bulk Payables allows you to send payments to multiple recipients using an easy and secure file upload capability that supports commercial payments and high-volume transactions. Interac e-Transfer Bulk Receivables makes it easy to invoice your customers or clients and receive guaranteed funds. It also simplifies the process for anyone to transfer payments to your business. For more information, please contact your financial institution:. Bulk Disbursements allows you to make multiple payments at once via Interac e-Transfer to streamline your payroll and supplier payment system. For more information, please contact your financial institution. Interac e-Transfer for Business Level up your business and skip the paperwork with an easy-to-use payment solution. The benefits of Interac e-Transfer for Business. Send and receive payments in real-time with immediate confirmation.

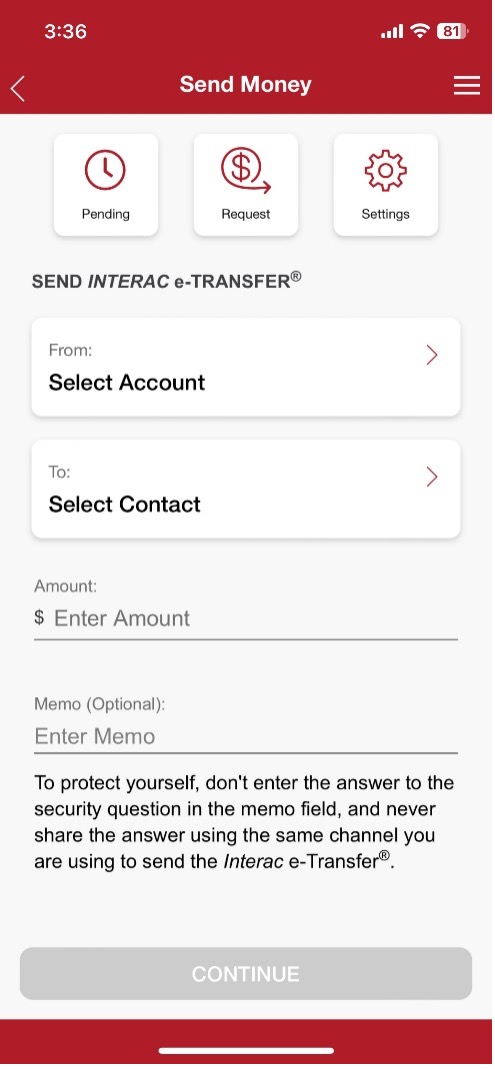

Reviewed By: Kristy DeSmit. Interac e-Transfer is a way to transfer money electronically between bank accounts at any financial institution, without requiring physical cheques or cash.

The easiest way to send and receive money in Canada is Interac e-Transfer. Money can be sent to anyone with an email address or a phone number in Canada, along with a Canadian bank account. Interac e-Transfer is available at over participating financial institutions across Canada, including all the major banks. There is, however, a limit to how much money can be sent via e-Transfer. This limit is set by financial institutions individually. Listed below are the transfer limits of some of the major Canadian banks and credit unions.

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. Customers of the same bank may also have different e-Transfer limits depending on the type of account they have personal or business or whether they have requested an increase. Not only that, but e-Transfer limits also vary depending on the type of transaction you are conducting, i. Interac e-Transfer is a secure and fast way to send money to recipients in Canada using your online banking. Instead of writing a cheque each time you want to pay someone or going to the ATM to withdraw cash, you can seamlessly send them funds using their email or phone number.

Vancity e transfer limit

A bonus for you and the planet. Offer ends March 31, Conditions apply. No more rushing to the ATM in search of cash or depositing cheques at the branch. All this, without having to share your bank details with anyone. Send money to anyone with an online banking account in Canada. All you need is their email or mobile phone number.

Ikea poang chair cover replacement

Used under license. The company started out offering international money transfers, and soon grew to include multi-currency accounts, business accounts, and a debit card. Step 1: Go into the e-Transfer option. Interac e-Transfers. For complete and updated product information please visit the product issuer's website. I want to… Start and grow my business Book an appointment. It should also be noted that the limit cannot be increased. Don't miss out. Repay or refinance your CEBA loan by the upcoming deadline and you may qualify for partial forgiveness. The transaction fee is non-refundable even if you cancel the transfer. On This Page.

This service is very prevalent in Canada and is employed by more than Canadian financial institutions.

Legal Privacy Accessibility Sitemap. Automated funds transfer Great for processing more than 10 pre-authorized debits per month. The security question and answer should be something the recipient will know but is not obvious to others. WOWA does not guarantee the accuracy of information shown and is not responsible for any consequences of the use of the calculator. Have a second? For more information, please contact your financial institution. The hour, 7-day and day limits are rolling limits based on the time the last e-Transfer was sent. And many platforms used by small online businesses like Etsy and Constant Contact have a PayPal interface already built in. Add an invoice number and due date for tracking in the comments field. Security - I have read of people using etransfer to send and the recipient not receiving, yet the money is gone. Learn more about insurance. Mortgage Term:. To find out more, you can contact your financial institution through phone, email, live chat or by visiting a branch.

What remarkable question