Vanguard life strategy

This means our website may not look and work as you would expect. Read more about browsers and how to update them here. With income units, any income is paid as cash.

A structured asset-allocation framework implemented by The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance.

Vanguard life strategy

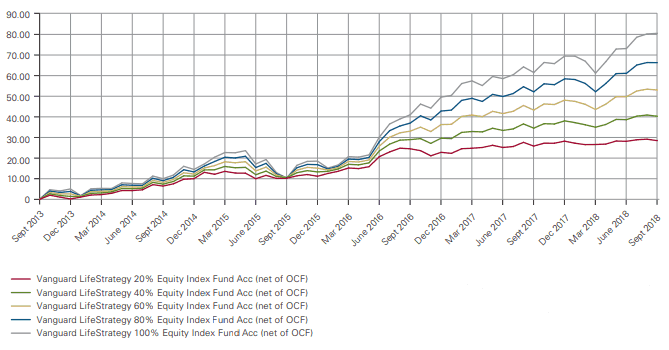

Keep investing simple with a ready-made fund portfolio. We monitor each LifeStrategy fund to make sure it sticks to the original balance of shares and bonds. Each LifeStrategy fund holds 6, to 20, shares and bonds around the world — helping to reduce your risk. Just pick the LifeStrategy fund that best fits your investment goal and attitude to risk. Building and managing your own portfolio is not for everyone. Each LifeStrategy fund combines multiple individual index funds into one fund portfolio, giving you access to thousands of shares and bonds in a single investment. This helps reduce risk by spreading your investments. Shares typically give you a higher return over the long run, but are riskier. Whereas bonds are more stable but offer lower potential returns. Having a mix of both helps balance risk and reward. When it comes to choosing a LifeStrategy fund there are two things you need to think about.. Shares offer higher potential returns than bonds — but are riskier. An adventurous investor on the other hand might want to choose a LifeStrategy fund with more shares. The longer you invest for, the more time you have to ride out any ups and downs in the stock market.

For detail information about the Quantiative Fair Value Estimate, please visit here. Vanguard U.

Without fail, the funds they recommend go on to underperform their benchmark indexes…after the magazine recommends them. Then I write my story, to poke a bit of fun. Magazines count on something Steve Forbes one said. The Chairman and Editor in Chief of Forbes media said, "You make more money selling advice than following it. It's one of the things we count on in the magazine business -- along with the short memory of our readers. That science says the best odds of picking strong fund performers comes from selecting those with low expense ratio costs. Low-cost funds have higher probabilities of future success compared to high-cost funds.

Vanguard has become a towering figure in the world of exchange-traded funds ETFs. As investors increasingly turn to ETFs for their diversification, lower costs, and liquidity, understanding the offerings and strategies of major players like Vanguard is essential. Here, we delve into the five critical factors about Vanguard ETFs, also explaining why a Bitcoin ETF is deliberately missing from their portfolio lineup. In the competitive ETF marketplace, cost efficiency is a significant battleground. Vanguard emerges as a victor here, offering the lowest average expense fees among its funds—an AUM-weighted average expense ratio of a mere 0. In , Vanguard outshines its competitors in attracting investment flows. Unlike some of its peers, Vanguard has opted for a more conservative route in its ETF offerings. The company does not offer leveraged ETFs, sticking strictly to equity and fixed-income products.

Vanguard life strategy

We started LoL Esports 14 years ago. We love LoL Esports and believe it has played an important role in helping extend the longevity of League of Legends. Because of this belief, Riot invests hundreds of millions of dollars annually in LoL Esports. The new model is closer to the one we've successfully implemented with the VCT - one with more predictable revenues for teams and financial upside driven by in-game digital items reflecting the support of LoL Esports fans across the globe. In this context, sustainability means that LoL Esports can generate enough revenue to cover the costs of Riot, our professional teams, and other stakeholders investing in our ecosystem while also providing an enduring career for our best players to compete professionally. Our community engages with the sport more than ever. The season and start have had milestones that give us so much confidence in the future. For all the highs of , however, the industry faced several business challenges, and we have not been immune to them. This reduction impacted all areas within Riot, including esports, and we are in the process of adjusting so we can deliver the esports you know and love, but with a focus on what moves the needle for the ecosystem at large. Many of the challenges I outlined last year are also still true today.

Pool table second hand

Notice the random performances of international markets below. However, on a risk-adjusted basis, these will be near the top. To invest in , you'll need to open an account. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. Shares offer higher potential returns than bonds — but are riskier. Equity, fixed income, property, money market, and alternative funds all suffered outflows in January. Buy: 33, Open an account Transfer an account to us. How much should you invest in stocks or bonds? See all search results for ' '. Contact us. Passive funds can be an excellent foundation for an investment portfolio, particularly for those keen to keep costs down.

Get our overall rating based on a fundamental assessment of the pillars below. The Vanguard LifeStrategy target-risk series' straightforward and efficient approach to delivering broad equity and fixed-income exposure should continue to serve investors well.

Try our handy filter and find out which suits you best. Try our handy filter to explore the different options. Prices as at 23 February If we are unsuccessful we will use the money to pay over any amounts due to HMRC. Each fund invests in thousands of U. Ready to invest? You may be interested in this fund if you care about long-term growth more than current income and want more growth potential while accepting higher exposure to stock market risk. You would never have to worry about the best time to rebalance. Here are the boxes they check, with respect to economic science:. Already a Vanguard client? Increase Decrease New since last portfolio. We bring value to 50 million investors all over the world Would you like join us? Management Manager Name. The 'initial saving from HL' will reduce the buying price, but even with a full discount the buying price may still be higher than the selling price.

Between us speaking, you did not try to look in google.com?

It is easier to tell, than to make.

This phrase is simply matchless :), it is pleasant to me)))