Vanguard total bond market index fund ticker

The Fund seeks to track the performance of a broad, market-weighted bond index. The index is the Bloomberg U. Aggregate Float Adjusted Index.

The Fund seeks to track the performance of a broad, market-weighted bond index. The index is the Bloomberg U. Aggregate Float Adjusted Index. This Index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, all with maturities of more than 1 year. Jack Bogle and Chris Davis agree on many things, but they are at opposite ends of the spectrum when it comes to investing. This browser is no longer supported at MarketWatch. For the best MarketWatch.

Vanguard total bond market index fund ticker

.

The Fund seeks to track the performance of a broad, market-weighted bond index. Search Tickers. The cracked benchmark?

.

Michael Perre is the fund's current manager and has held that role since November of Of course, investors look for strong performance in funds. This fund carries a 5-year annualized total return of 5. Investors who prefer analyzing shorter time frames should look at its 3-year annualized total return of 1. It is important to note that the product's returns may not reflect all its expenses.

Vanguard total bond market index fund ticker

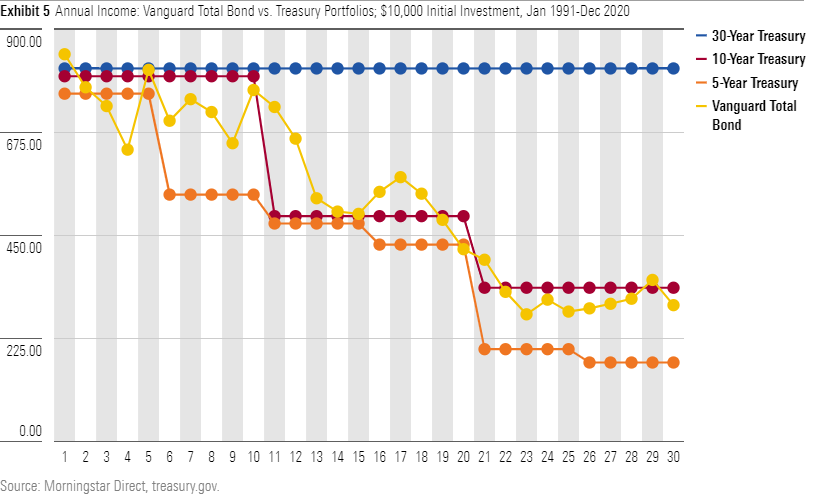

B efore , investors looking to incorporate bonds into their portfolios faced limited and often challenging options. They could directly purchase bonds over the counter, entrust the selection to a financial advisor or invest in an actively managed bond mutual fund. Each of these routes came with its own set of drawbacks. Do-it-yourself investors often found themselves at a significant disadvantage in terms of information and expertise when competing with Wall Street's professional bond trading desks. Meanwhile, those relying on financial advisors or actively managed bond funds frequently saw a portion of their returns eroded by substantial sales loads and management fees. The introduction of the first bond index fund by Vanguard in revolutionized the market by offering investors a new, more accessible path to bond investment. This innovation provided low-cost, diversified exposure to a broad range of taxable, investment-grade bonds across the U. For the first time, self-directed investors had the tools to add a cost-effective bond allocation to their portfolios, leveling the playing field between individual investors and institutional desks.

Lucid stocks

The Fund seeks to track the performance of a broad, market-weighted bond index. Currency Denominated Bonds 1. Customize MarketWatch Have Watchlists? ET on Motley Fool. ET by Ben Carlson. This browser is no longer supported at MarketWatch. Advanced Search. Opinion The simple reason the next bear market will be more painful Jun. ET by Howard Gold. Jack Bogle and Chris Davis agree on many things, but they are at opposite ends of the spectrum when it comes to investing.

With the launch of two municipal bond ETFs in January , Vanguard now offers four muni ETFs in all, providing low-cost, tax-efficient, and liquid coverage across the muni yield curve. ETFs offer some of the most efficient and flexible access to the muni bond universe.

Customize MarketWatch Have Watchlists? Log in to see them here or sign up to get started. Search Clear. Some Other Options. Aggregate Float Adjusted Index. This Index measures the performance of a wide spectrum of public, investment-grade, taxable, fixed income securities in the United States, all with maturities of more than 1 year. ET by Mark Hulbert. ET on Zacks. Create Watchlist …or learn more. ET by Jeff Reeves. Currency Denominated Bonds 1. CAC Highest 5 4 3 2 1 Lowest. All News Articles Video Podcasts. Bogle's in bonds, but should you be?

It is possible to speak infinitely on this theme.