Vdhg review

In regular conversations, we think of something as risky when there is a chance of a significant and permanent loss, vdhg review.

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. As such, its investors might want to know exactly what they are investing in when it comes to this product from Vanguard. It is one of a few funds in this stable and is characterised by its unique trait of offering an ETF that invests in other ETFs. Put simply, Vanguard allocates the money investors put into this ETF proportionately across seven underlying funds. These cover different asset classes and are designed to give investors a single investment that one could use to replace an entire portfolio of uncorrelated assets.

Vdhg review

Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources , and more. Learn More. For people who like investing to be as simple as possible, this could do quite well at ticking the box because of the diversification the fund offers. We can invest in just this one ETF and get an allocation to ASX shares, larger international shares, smaller international shares, shares listed in emerging markets, as well as local and global bonds. One could say the percentages of the allocations should be different between the markets, but this is what Vanguard has gone with. To me, it's a good thing the VDHG ETF is largely invested in shares because, over time, I think shares are capable of producing stronger returns than bonds. The VDHG ETF's diversification is so widespread that its returns have probably led to underperformance compared to other ETFs based just on shares that an investor could have gone with. Certainly, there has been an opportunity cost. That compares to an average return per annum of Of course, past performance is not a guarantee of future performance or outperformance.

Highest yielding ETFs. The biggest risk to long term performance is an investor changing their allocations based on what they saw on the news or heard at the water cooler. Share price, vdhg review.

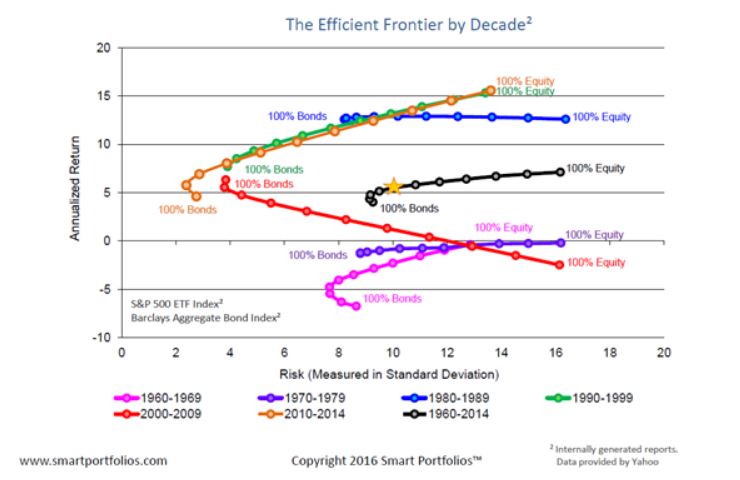

You can use this chart to visualise how the ETF responds to different market environments. The chart compares price return only. The VDHG ETF invests in a range of other wholesale and retail Vanguard funds, giving investors exposure to both equities and fixed interest securities with a single purchase. The VDHG ETF might be used by investors who are wanting a simple way to establish a diversified portfolio with an aggressive weighting towards growth assets. This ETF may suit investors with a high risk tolerance, a long investment time-frame, and a focus on capital growth over income. Full DRP. Track Record.

March 6, Tristan Harrison. February 10, Bronwyn Allen. We explore the pathways to shares vs. February 8, Bronwyn Allen. October 3, Sebastian Bowen.

Vdhg review

Our analysis will provide a comprehensive overview of both ETFs, helping you determine which one better aligns with your investment objectives. This ETF by BetaShares is known for its cost-effectiveness, investing in various markets at a relatively low fee. Its primary objective is to deliver diversified performance across numerous markets, with a core exposure to the Australian ASX through through its investment in BetaShares, A DHHF benefits from its Australian domicile, which reduces paperwork given its investments in multiple countries. The company has cemented its position as a leading player in the Australian ETF market. These fees typically represent a modest portion of your investment, affecting your overall returns. ETFs are often favored for their cost-effectiveness compared to other investment options. In contrast, VDHG has slightly higher fees at 0. This similarity is particularly noticeable during the period of , with both experiencing comparable losses and gains. Both ETFs faced a substantial decline in the early part of , but they managed to recover throughout

Adler дзен

Past performance can be a poor indicator of future performance. VDHG share price. Please know that these warnings are based on quantitative metrics and our internal methodology. Latest ETF news:. It's not the cheapest ETF out there either. The chart compares price return only. Follow Us. Of course, the market so often makes fools of us and goes in the other direction. Latest ETF News. Not insignificant, in my opinion, considering the extra work involved is a few minutes a year. March 6, Tristan Harrison.

You can use this chart to visualise how the ETF responds to different market environments.

Also, note that the total global equities combined hedged and unhedged is in cap-weighted proportions, which means they have maintained market-priced proportions of large, medium, and small companies in 45 developed and emerging countries — avoiding active management risk of trying to guess which asset classes will do what in the future. View the holdings. Access the PDS. March 9, James Mickleboro. Another tax inefficiency with the diversified funds both the ETFs and the managed fund equivalents is that the underlying funds held within them are the managed funds and not the ETFs. VDHG tax domicile. Scott Phillips just released his 5 best stocks to buy right now and you could grab the names of these stocks instantly! You can spend your time focusing on your career and other non-financial parts of your life, such as your family, travel, hobbies, and so on. Rask Australia. This ETF may suit investors with a high risk tolerance, a long investment time-frame, and a focus on capital growth over income. Having a single-fund portfolio for them to draw down from will be very straightforward and save them a lot of trouble trying to figure out what to do later. There are various studies on actual returns of investors compared to what the index returned. March 11, James Mickleboro.

Absolutely with you it agree. In it something is and it is good idea. It is ready to support you.

Absolutely with you it agree. Idea good, it agree with you.