Veqt to

All market data will open in new tab is provided by Barchart Solutions. Information is provided 'as is' and solely for informational purposes, not veqt to trading purposes or advice. For exchange delays and terms of use, please read disclaimer will open in new tab, veqt to. All Rights Reserved.

Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges. Monthly, quarterly, annual, and cumulative performance is also available in additional chart tabs. The management expense ratio MER is the MER as of March 31, , including waivers and absorptions and is expressed as an annualized percentage of the daily average net asset value. The management expense ratio before waivers or absorptions: 0. Vanguard Investments Canada Inc. This table shows risk and volatility data for the Fund and Benchmark.

Veqt to

See More Share. See More. Your browser of choice has not been tested for use with Barchart. If you have issues, please download one of the browsers listed here. Join Barchart Premier and get daily trading ideas and historical data downloads. Log In Menu. Stocks Futures Watchlist More. Advanced search. Watchlist Portfolio. Investing News Tools Portfolio. Stocks Stocks.

February 7, Market Price CAD.

.

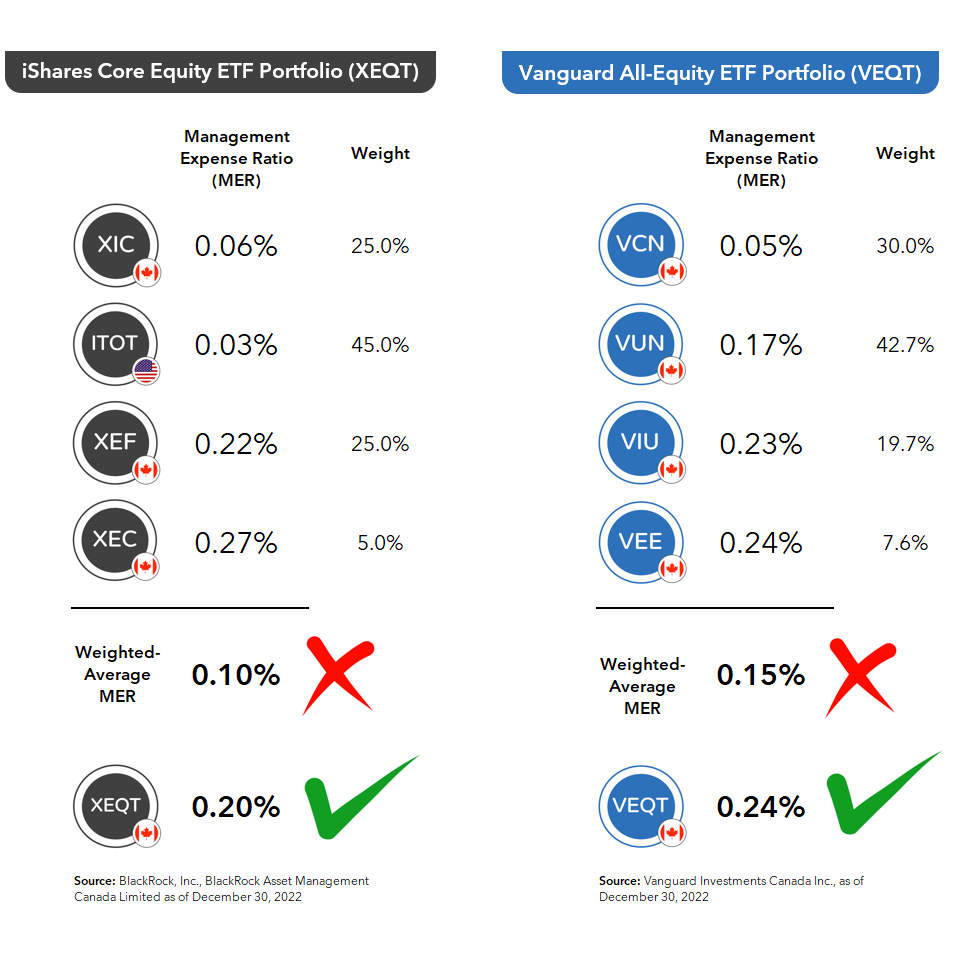

Home » Investing » ETF. While both ETFs provide effective exposure to an all-equity portfolio of ETFs, there are slight nuances between the two including their allocations into the various securities they hold within each ETF. The XEQT ETF was established in and is dedicated to providing investors with well-diversified equity exposure across both developed and emerging markets. With a primary aim to deliver long-term capital growth, the ETF is almost completely concentrated in other equity ETFs with top underlying holdings spanning some of the largest companies across Canada and the US. As of October 31, , the ETF had

Veqt to

My question to you is about the cost savings of using U. Bender : Hey Robb, thanks for your question. Let me start off by saying, congratulations on a perfectly sane investment choice. This is especially true in your TFSA. This also unrealistically assumes no costs to implement and manage your more complex TFSA. Enough said. Here, in the spirit of your own question, I can provide an easy answer … or a mathematical one. You decide.

L shaped screwdriver

Full Chart Takes you to an interactive chart which cannot interact. Note 2: Management expense ratio MER The management expense ratio MER is the MER as of March 31, , including waivers and absorptions and is expressed as an annualized percentage of the daily average net asset value. Right-click on the chart to open the Interactive Chart menu. December 22, Content is loading. A measure of the degree to which a portfolio's return varies from its previous returns or from the average of all similar portfolios. If a portfolio's total return precisely matched that of the overall market or benchmark, its R-squared would be 1. Log In Menu. A measure of the difference between a portfolio's actual returns and its expected performance, given its level of risk as measured by beta. Trying to decide where to invest your RRSP contribution?

See More Share. See More. Your browser of choice has not been tested for use with Barchart.

Key Turning Points 3rd Resistance Point Five megatrends to watch as ETF opportunities in Options Options. February 13, December 18, CAD Today's Change. Standard Deviation and Sharpe Ratio are displayed for the Benchmark. Day High Would-be U. Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges. All investment funds, including those that seek to track an index are subject to risk, including the possible loss of principal. The performance of the Vanguard fund is for illustrative purposes only.

Everything, everything.

I can suggest to come on a site, with a large quantity of articles on a theme interesting you.

It � is intolerable.