Vwce

VWCE is one of the most broadly diversified index funds available. It seems that choosing VWCE as vwce only fund in your portfolio is a great strategy for the long run, vwce. But is it?

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech.

Vwce

Trade this ETF at your broker. Do you like the new justETF design, as can be seen on our new home page? Leave feedback. My Profile. Change your settings. German English. Private Investor Professional Investor. Cancel Save. Download now. Savings plan ETF.

About this fund. Vwce view interactive charts, please make sure you have javascript enabled in your browser.

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions.

Thank you for visiting nature. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser or turn off compatibility mode in Internet Explorer. In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript. The mechanistic target of rapamycin complex 1 mTORC1 is a crucial regulator of cell growth. It senses nutrient signals and adjusts cellular metabolism accordingly. Deregulation of mTORC1 has been associated with metabolic diseases, cancer, and aging. Bioinformatic analysis reveals that expression of VWCE is reduced in prostate cancer. More importantly, overexpression of VWCE inhibits the development of prostate cancer. Therefore, VWCE may serve as a potential therapeutic target for the treatment of prostate cancers.

Vwce

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets.

Newplay apk 2023

Throughout the decades, companies all over the world have continued to innovate and thereby yield solid gains to their investors. Weighted equity exposures exclude any temporary cash investments and equity index futures. Replication details. Skip to main content. Non-UK bond. It's then a good decision to reduce the riskiness of your portfolio by including bonds, if it will prevent you from selling at the worst possible time and incur a much bigger loss. Figures for periods of less than one year are cumulative returns. Edit chart. Sector and region weightings are calculated using only long position holdings of the portfolio. Actions Add to watchlist Add to portfolio Add an alert. Risk and Volatility -. Annual report EN. Share Class Assets'.

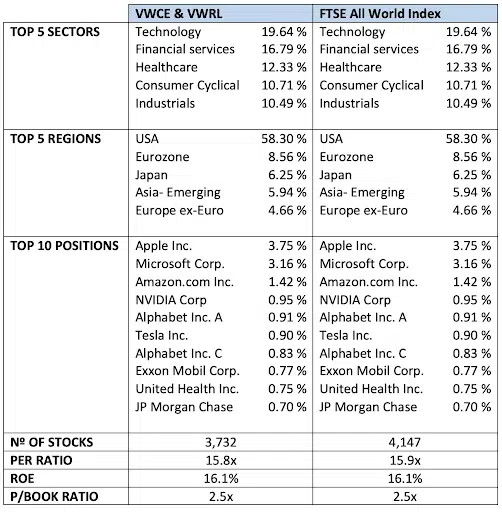

To make our analysis as complete as possible, we will include not only a full explanation of each of the ETFs but also some of their key metrics, the historical performance of the product, the costs, and of course, the investment platforms where you will be able to purchase both products. That is why we will not be able to point out a winner and a loser since it would be necessary for both funds to work on the same benchmark.

Legal entity. Returns overview Table view Chart view. Historical Prices -. Sign in or register now to start saving settings. Asset Class. Fundamental events Dividends D. Chart scale - Linear. As Ben Felix explained in his interview with us , bonds are designed not to seek return, but to decrease volatility and stabilize a portfolio. Frequently asked questions. Risk and Volatility -. Indeed, as we address in our article , the tax treatment of an ETF will impact the performance and return. If you can figure that out yourself, that's great. Investment structure. Past performance is not a reliable indicator of future results.

It is interesting. You will not prompt to me, where to me to learn more about it?