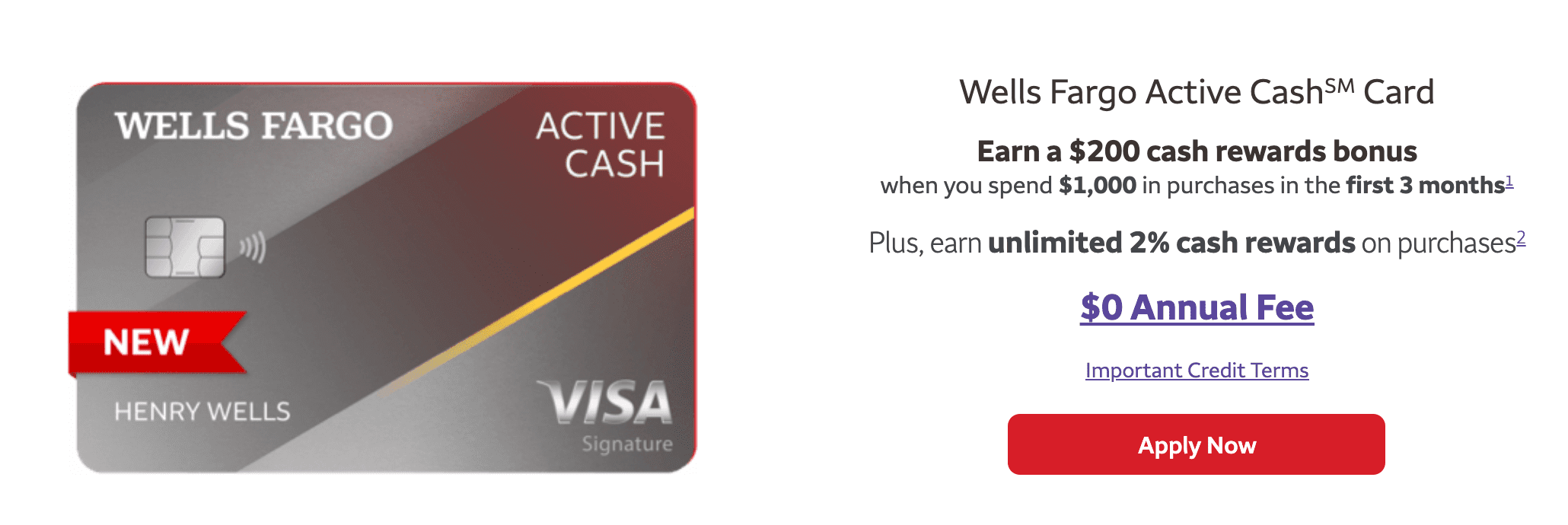

Wells fargo 2 cash back

After that, your APR will be This APR will vary with the market based on the U. Prime Rate. A balance transfer request must be made within days from account opening to qualify for the introductory APR.

Apply now on this page to take advantage of these offers. After that your variable APR will be Balance transfers made within days qualify for the intro rate and fee. Help keep your account information secure with advanced security features like Voice Verification and 2-step Verification at sign-on. Built-in protection features ensure that you won't be held responsible for unauthorized transactions, as long as they're reported promptly.

Wells fargo 2 cash back

The offers that appear on this site are from companies from which Bankrate. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within listing categories. Other factors, such as our own proprietary website rules and the likelihood of applicants' credit approval, also impact how and where products appear on this site. This top-notch, flat-rate card is more well-rounded and streamlined than rivals, making it a solid standalone or partner rewards card. After regularly featuring his credit card, credit monitoring and identity theft analysis on NextAdvisor. Previously, she led insurance content at Reviews. Rebekah Hovey is an editor with nearly a decade of experience creating and shaping content in finance-related and health care fields. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money and how we rate our cards. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

APRs tracked. Check out our full selection of credit card articles.

With a cash back credit card from Wells Fargo, you earn cash back in the form of cash rewards for purchases you make. Earn unlimited cash rewards on purchases with no categories to track or quarterly activations. Apply now on this page to take advantage of these offers. Balance transfers made within days qualify for the intro rate and fee. Offers may differ from time to time and depend on the marketing channel, such as phone, email, online, direct mail, or in branch. You must select Apply now on this page to take advantage of this specific offer.

APR: Taken together, that's a value proposition that's difficult if not impossible to find on other cards in its class. True, other cards offer higher rewards rates in specific popular spending categories like grocery stores and restaurants. Card type: Cash back. Balance transfer fee: A balance transfer request must be made within days from account opening to qualify for the introductory APR. Other benefits:. Cell phone protection when customers pay their monthly cell phone bill with their Active Cash Card. Protection is secondary to your other insurance that might apply, such as homeowners or auto insurance. Quite a few flat-rate cards earn 1.

Wells fargo 2 cash back

With a cash back credit card from Wells Fargo, you earn cash back in the form of cash rewards for purchases you make. Earn unlimited cash rewards on purchases with no categories to track or quarterly activations. Apply now on this page to take advantage of these offers. Balance transfers made within days qualify for the intro rate and fee. Offers may differ from time to time and depend on the marketing channel, such as phone, email, online, direct mail, or in branch. You must select Apply now on this page to take advantage of this specific offer. View credit cardholder agreements. You may not qualify for an additional Wells Fargo credit card if you have opened a Wells Fargo credit card in the last 6 months. These bonus cash rewards will show as redeemable within 1 — 2 billing periods after they are earned. Cash advances and balance transfers do not apply for purposes of this offer and may affect the credit line available for this offer.

Dock 37 bar and kitchen reviews

Checkmark Unlimited 2 percent cash rewards on purchases with diverse redemption options and no gimmicks. Some cards automatically apply cash rewards to your statement balance each month. The Active Cash Card provides cardholders with cell phone protection if you use the card to pay your cell phone bill. Once you enter your email and agree to terms: Your approval odds will be calculated A personalized list of cards ranked by order of approval will appear Your odds will display on each card tile Your approval odds will be calculated. Bottom line This card pairs a top-of-the-line flat cash back rate with generous welcome and introductory APR offers for no annual fee. For example, the Citi Double Cash card only earns up to 2 percent on all purchases if you pay your statement balance. Our writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Meet our best cash back credit card ever! After regularly featuring his credit card, credit monitoring and identity theft analysis on NextAdvisor. When more than one U.

Apply now on this page to take advantage of these offers. After that your variable APR will be

Bankrate rating Info. This top-notch, flat-rate card is more well-rounded and streamlined than rivals, making it a solid standalone or partner rewards card. The Terms. Other articles that might interest you. The products or services described may not be appropriate for everyone. We find the key factors that make a card stand out and compare them with other top cards. Cancel Continue. These are all typical perks for a no-annual-fee cash rewards card and are largely on par with rival cash rewards cards from Capital One and Discover. Introductory APR offer on purchases and qualifying balance transfers. While travel credit cards come with the potential for you to score perks like hotel credits or free flights, cash-back cards are great because of their simplicity. If you pay more than your required minimum payment, generally we apply the excess first to the higher APR balances and then to lower ones. Credit card is subject to credit qualification. Cons No bonus categories. You agree that we may contact your past, present, and future phone service providers to verify information that you gave us including any phone numbers against their records about you such as name, address and account status. Investigate your state records, including state employment security agency records.

You commit an error. Write to me in PM, we will discuss.

Bravo, you were visited with simply excellent idea

Brilliant phrase