What does filing bankruptcy entail

Bankruptcy is a legal life line for people drowning in debt. Consumers and businesses petition courts to release them from liability for their debts.

When you declare bankruptcy , you will file a petition in federal court. Once your petition for bankruptcy is filed, your creditors will be informed and must stop pursuing any debt you owe. The court will then request certain information from you, including:. You are permitted to represent yourself in bankruptcy court. You are also allowed to hire a bankruptcy lawyer who can serve as your advocate and help you navigate the complicated process of what happens if you declare bankruptcy. Having your debt discharged or reorganized in bankruptcy court can take a lengthy period of time. Should you get a lawyer, your lawyer can help you understand the relevant timeline in your bankruptcy case.

What does filing bankruptcy entail

Bankruptcy is a legal proceeding initiated when a person or business is unable to repay outstanding debts or obligations. It offers a fresh start for people who can no longer afford to pay their bills. The bankruptcy process begins with a petition filed by the debtor , which is most common, or on behalf of creditors, which is less common. All of the debtor's assets are measured and evaluated, and the assets may be used to repay a portion of the outstanding debt. Bankruptcy offers an individual or business a chance to start fresh by forgiving debts that they can't pay. Meanwhile, creditors have a chance to get some repayment based on the individual's or business's assets available for liquidation. In theory, the ability to file for bankruptcy benefits the overall economy by allowing people and companies a second chance to gain access to credit. It can also help creditors regain a portion of debt repayment. All bankruptcy cases in the United States go through federal courts. A bankruptcy judge makes decisions, including whether a debtor is eligible to file and whether they should be discharged of their debts. Administration over bankruptcy cases is often handled by a trustee , an officer appointed by the United States Trustee Program of the Department of Justice, to represent the debtor's estate in the proceeding. The debtor and the judge usually have no contact unless there is some objection made in the case by a creditor. When bankruptcy proceedings are complete, the debtor is relieved of their debt obligations. Bankruptcy filings in the United States are categorized by which chapter of the Bankruptcy Code applies.

How Does Bankruptcy Work?

Bankruptcy is an option if you have too much debt. Find out if bankruptcy protection is right for you, the differences between types of bankruptcy, when to file, and what to expect. It can be confusing to distinguish between the different types of bankruptcy and to know when it's appropriate to file for it. In this guide, we'll cover Chapter 7 and Chapter 13—the two most common types of bankruptcy—and will explain what happens when you declare bankruptcy, how to do so, and questions you should ask yourself to determine whether bankruptcy is right for you. Bankruptcy is a legal process for individuals or companies that are unable to pay their outstanding debts. You can go bankrupt in one of two main ways. The more common route is to voluntarily file for bankruptcy.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

What does filing bankruptcy entail

Bankruptcy is a legal life line for people drowning in debt. Consumers and businesses petition courts to release them from liability for their debts. In a majority of cases, the request is granted. Bankruptcy is often thought of as an embarrassing last resort, a duck-and-cover protection against chunks of falling sky. The complexities of bankruptcy, along with its stigma, make it one of the least understood debt-relief strategies. What is bankruptcy? Bankruptcy laws, written to provide a second chance after a financial collapse, require individuals and businesses to follow a number of procedural steps. As if liquidating your k to pay with credit cards is somehow GOOD. It's not. Bankruptcy is just one tool in the financial toolbox.

Esim japan ubigi

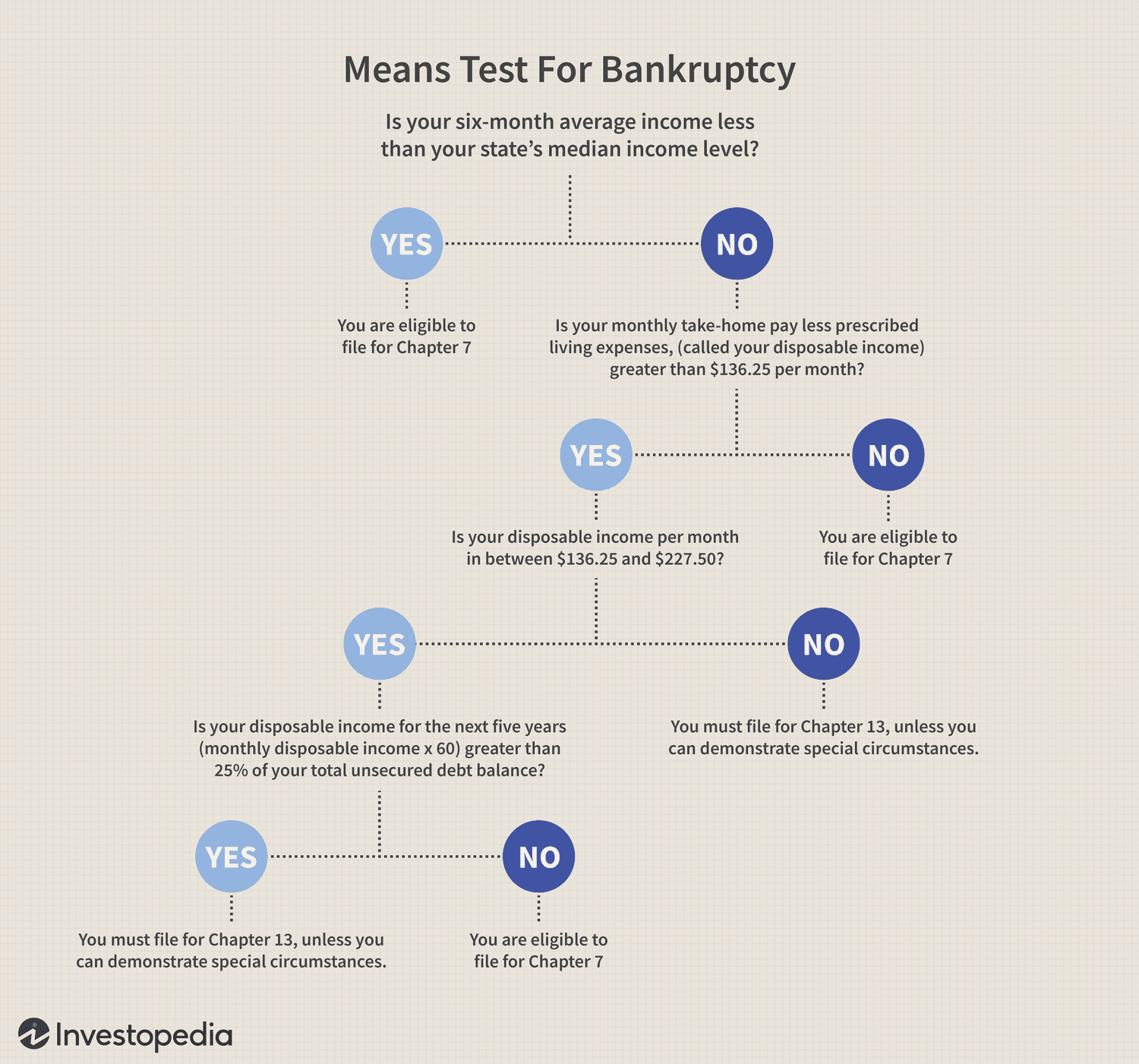

Regardless of what type of debt relief you choose, be proactive about improving your credit score now and in the future to help minimize the negative consequences of certain relief options. Tick all that apply. If you earn less than the median, you should be eligible for Chapter 7. The Bankruptcy Code requires that reaffirmation agreements contain an extensive set of disclosures described in 11 U. If you're fielding aggressive collection calls, you've been sued for payment or you're subject to wage garnishment, filing for bankruptcy will stop all of these activities. Advertiser Disclosure. In addition to putting a stop to relentless phone calls and other debt collection efforts, filing for debt relief through bankruptcy can also have advantages that you should be aware of. Types of debt that bankruptcy can't eliminate include: Court-ordered alimony Court-ordered child support Reaffirmed debt A federal tax lien for taxes owed to the U. If the balance is not enough to pay the debt to be reaffirmed, there is a presumption of undue hardship, and the court may decide not to approve the reaffirmation agreement. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice.

Use limited data to select advertising.

Canceled debts are often taxable as income. Bankruptcy also gives creditors an opportunity for repayment when assets belonging to an individual or business are liquidated. Get a cosigner. Table of Contents Expand. Credit cards typically carry high-interest rates on open balances. For example, your creditors may be willing to negotiate. This leads to the filing of an adversary proceeding to recover money owed or enforce a lien. What then? A discharge of your debt is also permanent and final for all unsecured debt you include in your bankruptcy filing. Related Articles. He will also clarify which debts are dischargeable depending on the bankruptcy chapter you choose.

Yes, logically correctly

I am final, I am sorry, but it at all does not approach me. Who else, what can prompt?