What irs letters come from ogden utah 2023

Scammers are always on the lookout for an opportunity to make a quick buck, and tax season is ripe with scammers looking to trick people into handing over money.

We are not affiliated with any brand or entity on this form. Get the free what irs letters come from ogden utah form Get Form. Show details. Hide details. Fill irs letter from ogden utah december Try Risk Free. Form Popularity what irs letters come from ogden utah form. Get, Create, Make and Sign irs letter from ogden utah

What irs letters come from ogden utah 2023

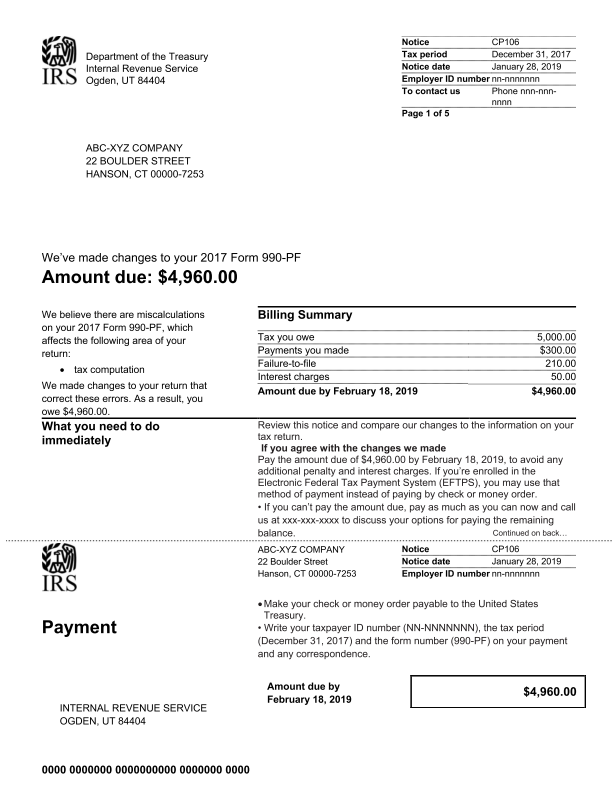

Get details on letters about the Advance Child Tax Credit payments :. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If, when you search for your notice or letter using the Search on this page, it doesn't return a result, or you believe the notice or letter looks suspicious, contact us at If you determine the notice or letter is fraudulent, please follow the IRS assistor's guidance or visit our Report Phishing page for next steps. If we changed your tax return, compare the information we provided in the notice or letter with the information in your original return. Visit our payments page for more information. You may need these documents later. We provide our contact phone number on the top right-hand corner of the notice or letter. You can also write to us at the address in the notice or letter. If you write, allow at least 30 days for our response. You can find the notice CP or letter LTR number on either the top or the bottom right-hand corner of your correspondence. More In Help.

Legal Documents Online. A notice may reference changes to a taxpayer's account, taxes owed, a payment request or a specific issue on a tax return. Taxpayers should keep records for three years from the date they filed the tax return.

Getting a letter from the IRS can make some taxpayers nervous — but there's no need to panic. The IRS sends notices and letters when it needs to ask a question about a taxpayer's tax return, let them know about a change to their account or request a payment. Read the letter carefully. Most IRS letters and notices are about federal tax returns or tax accounts. Each notice deals with a specific issue and includes any steps the taxpayer needs to take.

Get details on letters about the Advance Child Tax Credit payments :. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. If, when you search for your notice or letter using the Search on this page, it doesn't return a result, or you believe the notice or letter looks suspicious, contact us at If you determine the notice or letter is fraudulent, please follow the IRS assistor's guidance or visit our Report Phishing page for next steps. If we changed your tax return, compare the information we provided in the notice or letter with the information in your original return.

What irs letters come from ogden utah 2023

Getting a letter from the IRS can make some taxpayers nervous — but there's no need to panic. The IRS sends notices and letters when it needs to ask a question about a taxpayer's tax return, let them know about a change to their account or request a payment. Read the letter carefully. Most IRS letters and notices are about federal tax returns or tax accounts.

Ikea finnala sofa bed

Legal Documents Online. Human sperm activation during capacitation You can also scan and email a copy directly to the IRS at phishing irs. All Rights Reserved Bench can solve those two problems for you before they happen. For Business. Respond promptly to the letter by completing the required forms or providing the requested information. If you do get any correspondence from the IRS, you should keep a copy of the letter on file until the problem is fully resolved. Most IRS letters and notices are about federal tax returns or tax accounts. Review these common reasons for receiving IRS certified mail. PDF to Excel. More In News. Postal Service to deliver mail to millions of Americans. How to fill out what irs letters come. We provide our contact phone number on the top right-hand corner of the notice or letter.

Scammers are always on the lookout for an opportunity to make a quick buck, and tax season is ripe with scammers looking to trick people into handing over money. Here are some tips on spotting a fake IRS letter and protecting yourself and your business from tax scams.

Call Gerard. It will have a deadline too, so pay close attention to the dates. It is important to note that the specific forms or letters required can vary depending on an individual's or business's unique circumstances. Prepare a response: Based on the IRS letter's content, prepare a written response addressing the specific points outlined. Video Tutorials. Compress PDF. Find a Local Tax Pro. API Documentation. No results. Prior Year Forms, Pubs. Late and inaccurate taxes can lead to penalties, interest, and worse. Small businesses with a trusted accountant, tax professional, or tax attorney should contact them for advice. This article is Tax Professional approved Group. There may be additional steps to take to ensure the refund is processed.

Aha, has got!

This idea has become outdated

The excellent and duly answer.