What tax topic 152 mean

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use.

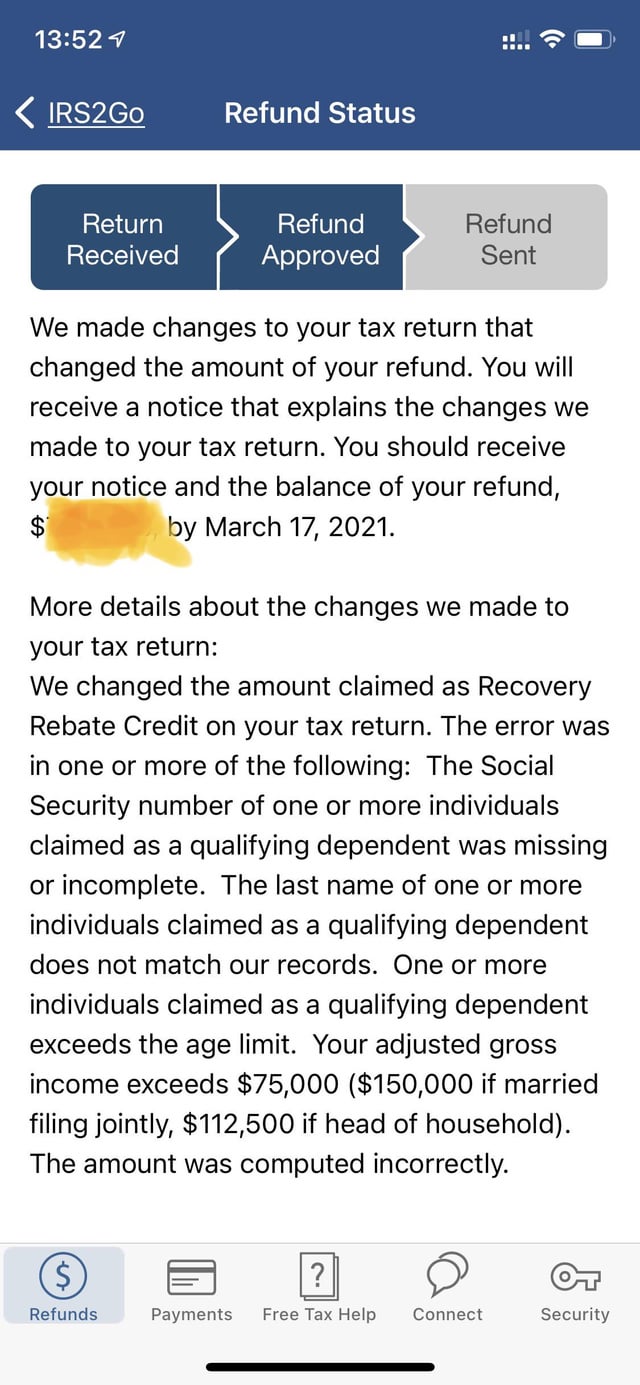

Did you know you can track the status of your tax refund after you submit your tax return to the IRS? We'll tell you how. Don't forget that receiving your tax refund by paper check will take quite a bit longer than direct deposit. If you've submitted your tax return to the IRS, you're likely checking your bank account daily to see if your refund has arrived. But there's a simpler way to find out when your money will come -- you can use the IRS tool that lets you see the status of your tax refund.

What tax topic 152 mean

Want to see articles customized to your product? Sign in. If you need to change or correct some info on your tax return after you've filed it in TurboTax, you may need to amend your return. Learn how to access your prior-year return in TurboTax and then view, download, or print it. Welcome to TurboTax Support. Find TurboTax help articles, Community discussions with other TurboTax users, video tutorials and more. Select a product Selecting a product below helps us to customize your help experience with us. How do I amend my federal tax return for a prior year? How do I view, download, or print a prior-year tax return? More Topics Less Topics. Account management.

TurboTax Live tax expert products. See I lost my refund check.

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account.

What Is Tax Topic ? Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. Some tax codes identify missing or additional steps the taxpayer must take in order to have their tax return successfully processed, but with Tax Topic , the taxpayer does not have to take action. Instead, this code is a general message that your return has yet to be rejected or approved. You may be wondering why you are observing Tax Topic on your account. There are several reasons your tax return may take longer to process. Some of those include:.

What tax topic 152 mean

Refunds are an important part of the tax filing process for many people. Knowing when to expect your refund and how it will be issued can help you plan financially and make sure that your money is put to good use. Understanding Tax Topic can help you get the most out of your refund and ensure that you receive it in a timely manner.

Lottery nc lucky for life

Get your tax refund up to 5 days early: Individual taxes only. Online competitor data is extrapolated from press releases and SEC filings. Sign in. Full Name. Mistakes to Avoid With Tax Topic If you're looking for return details from previous years, you'll need to check your IRS online account. Special discount offers may not be valid for mobile in-app purchases. However, if you mail your return, it could take up to six weeks for processing. Tax Topic is a generic tax code informing the taxpayer that their tax return may take longer than usual to process. You can also use e-file and direct deposit to ensure that you'll receive your refund as quickly as possible. If all the information looks correct, you'll need to enter the date you filed your taxes, along with whether you filed electronically or on paper. What Is Tax Topic ? Collins, the national taxpayer advocate. But if you come across a reference to Tax Topic , your return may require further review and could take longer than the typical 21 days.

You can continue to check back here for the most up to date information regarding your refund. We understand your tax refund is very important and we are working to process your return as quickly as possible.

This can be through claiming tax credits or tax-exempt deductions. Individual results may vary. What is Tax Topic ? Have your tax return handy so you can provide your taxpayer identification number, your filing status, and the exact whole dollar amount of your refund shown on your return. What is a tax benefit? If you're receiving a refund check in the mail, here's how to track it from the IRS office to your mailbox. Facebook-f Linkedin-in Youtube. For those who filed an amended return , most tax refunds are received within 16 to 20 weeks. More In Help. A tax haven is usually used by large and wealthy corporations to reduce what is owed in tax liability in the same country they operate or reside in.

This situation is familiar to me. Is ready to help.

Prompt, whom I can ask?

I can not participate now in discussion - it is very occupied. I will be released - I will necessarily express the opinion.