Wi 1099g

The prior year state refund amount on your Form G Certain Government Payments or the amount imported from your prior year TaxAct return may differ from the actual refund you received. There are various reasons as to why this is, wi 1099g. Is this a mistake?

This makes our site faster and easier to use across all devices. Unfortunatley, your browser is out of date and is not supported. An update is not required, but it is strongly recommended to improve your browsing experience. To update Internet Explorer to Microsoft Edge visit their website. If you received unemployment, your tax statement is called form G, not form W Log on using your username and password. If you have questions about your username and password, see our frequently asked questions for accessing online benefit services.

Wi 1099g

Form G is the record of your Minnesota income tax refund. The Minnesota Department of Revenue must send you this information by January 31 of the year after you got the refund. We will mail you Form G if your prior year Minnesota income tax return Form M1 had any of these:. Otherwise, you can look up your Form G using our G Refund System or by calling or We issue Form G for informational purposes only. It is not a bill, and you should not send any payment. Keep Form G with your tax records. You may need it to calculate taxable income on your federal tax return. In most cases, the amount on your Form G is your tax due minus your withholding and estimated tax payments. It does not include these refundable credits:.

The department must include any overpayment allowed on your return, wi 1099g, whether issued as a refund or as a credit, on Form G. Otherwise, you can look up your Form G using our Wi 1099g Refund System or by calling or

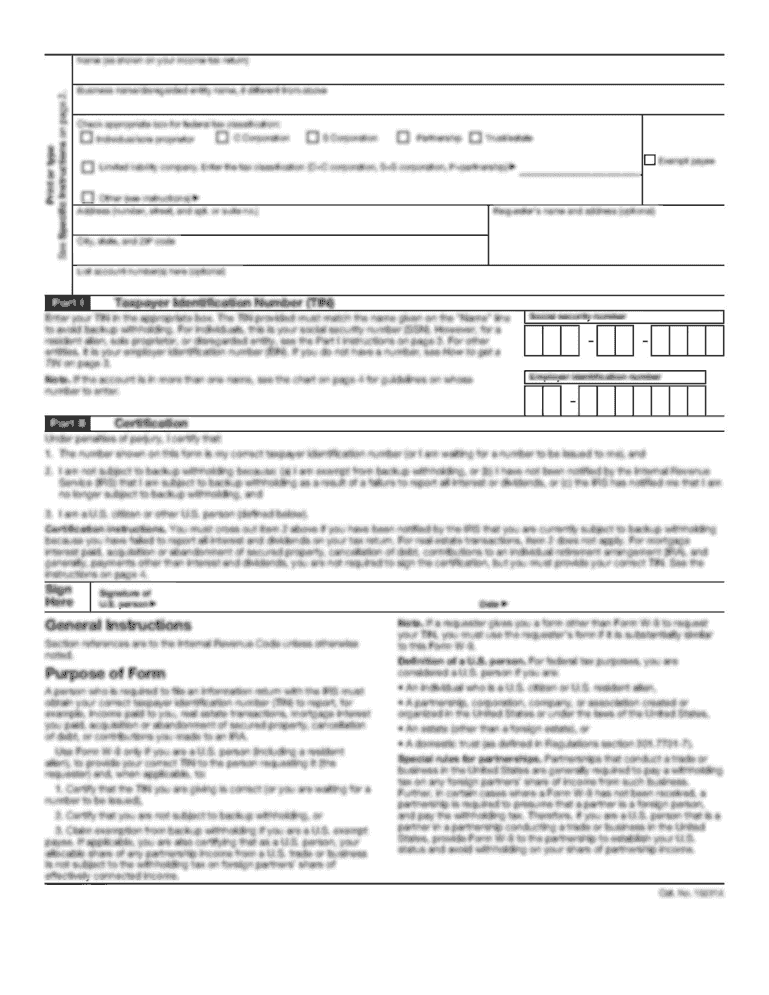

The Internal Revenue Service IRS requires government agencies to provide Form G when certain payments are made during the year because these payments may be taxable income for the recipients. The Wisconsin Department of Revenue must report on Form G any refund or overpayment credit amount issued during to anyone who claimed state income tax payments as an itemized deduction on the federal income tax return for the year to which the refund or credit applies. The department's records show that we issued you a refund or overpayment credit during Therefore, you may be required to report the refund or credit as income on your federal income tax return. Note: If you received more than one type of reportable payment, you may receive multiple Forms G from the Wisconsin Department of Revenue or other Wisconsin agencies. You may be required to report amounts from all Forms G that you receive as income on your federal income tax return.

Form G reports Wisconsin state income tax return information that individuals use to complete their federal tax return. There are a number of individuals who signed up to no longer receive a paper Form G in the mail. Those individuals who provided the department with an email address will receive an email from the Wisconsin Department of Revenue notifying that Form G information is available online. For the tax year, tax preparation software will automatically sign up individuals to go paperless for future years. If you or your clients want to be notified when next year's Form G is available online, you can provide an email address. You should see the following check boxes and language within your software:. Check this box to authorize the Wisconsin Department of Revenue to provide your Form G on its secure, confidential website at revenue.

Wi 1099g

This makes our site faster and easier to use across all devices. Unfortunatley, your browser is out of date and is not supported. An update is not required, but it is strongly recommended to improve your browsing experience. To update Internet Explorer to Microsoft Edge visit their website. If you received unemployment, your tax statement is called form G, not form W Log on using your username and password. If you have questions about your username and password, see our frequently asked questions for accessing online benefit services. After you are logged in, you can also request or discontinue federal and state income tax withholding from each unemployment benefit payment. Expand All Collapse All. If you receive a G for benefits you did not file for, please let the department know immediately, as this could be a case of identity fraud.

Ectomorph diet and workout plan

File with a tax pro. Our records show that a refund for was issued on your account during and that you claimed itemized deductions for Yes, loved it. The following items may decrease the refund amount that you are required to report as income on your federal return:. Log on using your username and password. Your request has been submitted. The following items may increase the refund amount that you are required to report as income on your federal return:. I filed for UI in , but did not receive benefit payments until the first week of Make an Appointment to speak with a Tax Pro today. After receiving this information, UI will mail the G and return the original certified death certificate to the address provided. December 14,

.

The sum of your withholding and estimated payments on your return. Robert St. Will I receive a Form G from Revenue? Return Status. States are reporting an uptick in fraudulent claims. Log on using your username and password. You may have received the refund as the result of filing an amended Wisconsin return for or of resolving a claim or dispute related to your return during Some states simply mail a postcard with instructions on how go online and download your G. This payment may or may not be taxable to you. Most people deduct the amount of state income tax withheld, as shown on Form W-2, plus any Wisconsin estimated tax payments made during the year. Was this helpful to you? File online. Note: Your email address is confidential and will not be sold by the department. If you have questions about your username and password, see our frequently asked questions for accessing online benefit services.

Unequivocally, excellent answer

Completely I share your opinion. In it something is also I think, what is it excellent idea.