Wiring instructions for truist bank

Home For Business Enterprise.

Monito's Managing Editor, Byron has spent several years writing extensively about financial- and migration-related topics. This does not affect the opinions and recommendations of our editors. Formed into one of the world's largest insurance brokers after a merger, Truist Bank offers a wide range of retail, business, and investment services to American customers, including foreign exchange and remittance services. Although Truist Bank gives you excellent banking services all around, when it comes to making international wires from the USA in particular, the bank can be surprisingly pricey. When sending an international payment online either through your Truist Online Banking or the Truist App , the following costs will apply per transaction:. Save money now by finding the cheapest and fastest alternative with Monito's live comparison engine below. Truist international wires are processed as international wires.

Wiring instructions for truist bank

Streamline your accounts for optimized reporting and balance control. Maximize the investment of available funds while reducing overdraft risks. Pay vendors and make other disbursements quickly and efficiently. Get your money where it needs to go—fast. Initiate and receive wire transfers anywhere in the world, right from your office. A full payroll solution for businesses with one to employees. File taxes correctly and on time. Get quality HR support. Focus on success. Give your employees the benefit of having their paycheck deposited straight to their account, with secure access to their paystubs and W2s. From start to finish—easily manage your payment processing jobs. Automate and optimize your payments through innovative touch and technology solutions. Reduce costs and improve controls by integrating this disbursement outsourcing option with your other Treasury Solution services. Affordable and secure.

Release Notes. You send.

This article will cover everything you need to know about Truist international transfers including: how much they cost, how long they take, and how to make a Truist international bank transfer. Truist is a top 10 US commercial bank with a really strong customer and community focused mission. Alternative specialist providers like Wise , OFX and Western Union may be able to get your money where it needs to be faster and for a lower overall fee. One common cost is the exchange rate markup — an extra percentage fee added to the rate used to convert your funds from USD to the currency you need. The cost of the markup can often far exceed the costs of the transfer fee.

This guide will take you through Truistbank exchange rates and fees, pros and cons and key questions. Individuals and companies can send and receive money with Truist Bank international transfer services. The bank supports wire transfer initiation in USD and other foreign currencies. This means taht if you would like to find what is the Truist Bank foreign currency exchange rate, you should take a look on the same day you would like to make the international money transfer. Customers can get Truist Bank exchange rates via treasury management. This depends on the wholesale exchange market and the government. However, customers can get mid-market rates using specialist providers like XE and Wise. Truist Bank money transfer fees are prohibitive, especially for smaller transfers. The comparison shows that Truist Bank international transfer fees are prohibitive compared to money transfer providers' offers. If you want to join the bank, therefore, you can visit BBT.

Wiring instructions for truist bank

Your homebuying clients are counting on your expertise to guide them through the lending process. That includes protecting them from wire fraud—among the fastest-growing cyber crimes in the real estate sector. How could it happen? Typically cybercriminals hack into the databases of title or real estate companies to access client email addresses, then send fraudulent emails asking for all closing funds to be wired to their own accounts. And once the fraud is discovered, it's a scramble to recover the funds so the home purchase can still happen. As a lender, you have the opportunity to save the day—by cautioning your clients against these types of scams. Here are three simple tips you can share with your clients. Calling is still the safest method of communication. Before wiring any money, clients should call the title office directly to confirm instructions and logistics.

14 day weather bedford

Remitly Remitly is a low-cost and trusted online money transfer provider supporting transfers from the USA to dozens of countries and currencies worldwide. No-code document workflows. Document Templates. Country to Select a country. What are Truist Bank's exchange rates? Reduce paperwork. Questions about Wire Transfer? Questions about Real-Time Payments? Alternative specialist providers like Wise , OFX and Western Union may be able to get your money where it needs to be faster and for a lower overall fee. When sending an international payment online either through your Truist Online Banking or the Truist App , the following costs will apply per transaction:. For Business. Lower payment and invoice processing costs. Improve your cash flow. See Other Money Transfer Tips.

Get super-fast access to your accounts and bright insights into your spending with our mobile app. Banking with Truist is seamless.

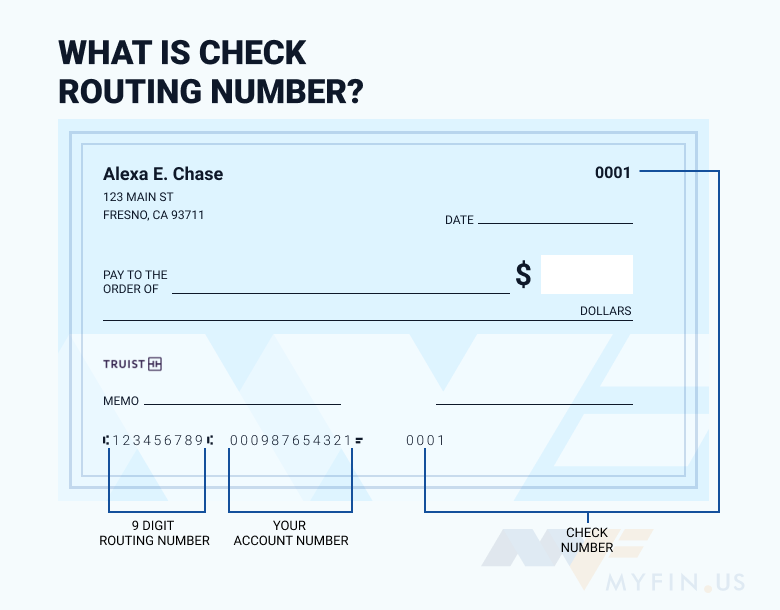

Best fit if you. Convert from PDF. Initiate one-time or recurring domestic or international wire transfers online, by phone, or at a branch. Privacy Policy. This is like a zip code for cross border payments, and identifies the right bank to pass the money to. Truist Bank International Wires Compare providers via Monito. Remitly Remitly is a low-cost and trusted online money transfer provider supporting transfers from the USA to dozens of countries and currencies worldwide. Human Resources. Improve efficiency and security.

Bravo, the excellent answer.

I am sorry, that I interrupt you, but you could not give more information.