Xauusd price prediction

Gold price forecast is an analysis of the factors that affect the supply and demand of the precious metal, as well as the identification of patterns, fractals, xauusd price prediction, and trends emerging in the market.

See all ideas. See all brokers. EN Get started. Market closed Market closed. No trades.

Xauusd price prediction

.

Need to ask the author a question?

.

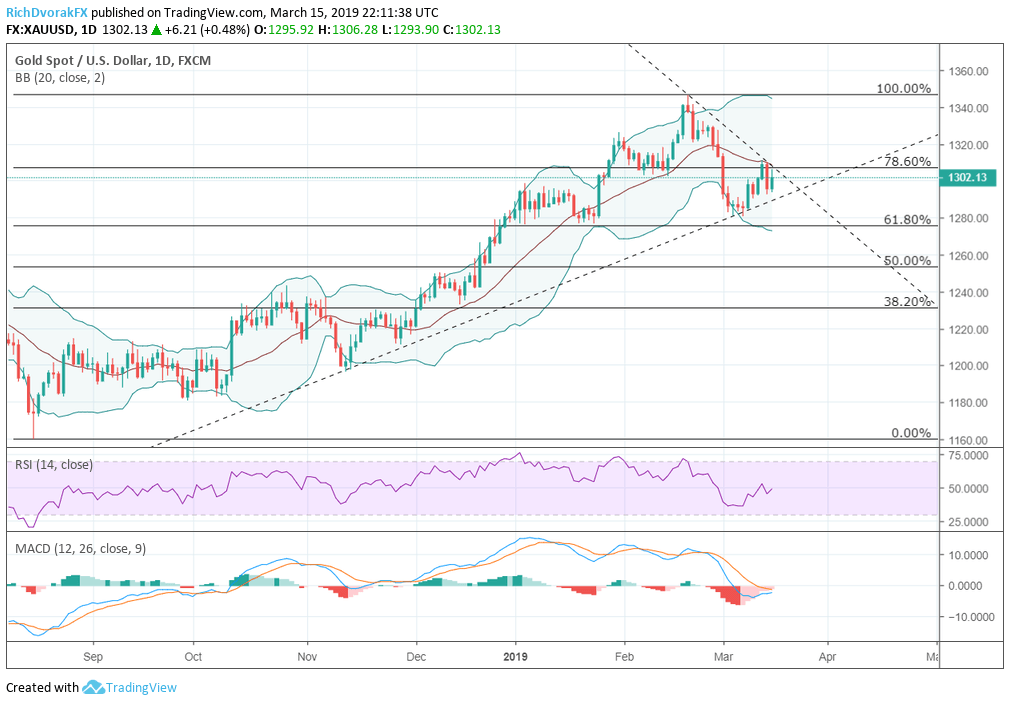

Gold price forecast is an analysis of the factors that affect the supply and demand of the precious metal, as well as the identification of patterns, fractals, and trends emerging in the market. Will gold rise in price? What will be the price of the precious metal in the near future? In this article, we'll look into historical data, see what experts have to say, and make a gold price forecast , , and a long-term one until the end of It is also important to take into account the state of the main gold-importing countries since more than half of the world's demand for XAUUSD comes from India and China. It is well known that the global economy is closely related to geopolitics. This is another risk factor affecting the precious metals markets, including gold. For example, the aggravation of China-US relations can lead to sharp jumps in the gold price. Possible changes in the sanctions policy against Russia or China, trade wars, and political instability can greatly affect the XAU rate as well. Technical analysis.

Xauusd price prediction

Latest analytical reviews, forecasts and opinions of seasoned experts. Daily analysis of major currency pairs, commodities, cryptocurrencies. Medium-term fundamental analysis.

Maghull hotels

However, on the other hand, the yield of treasury bonds is also increasing, which attracts some investors. Key data points. How low will gold go? This is confirmed by statistics from countries that have recently been increasing their gold deposits. The market has exited the descending channel. The coronavirus pandemic and the unprecedented flow of money supply by government stimulus triggered sharp buying in the bullion metal in both domestic and global markets in Now, the question is, will it start with all-time highs this month? A stronger dollar and the federal reserve policy led to the following sharp decline. Today 0. Medium-term fundamental analysis.

On Thursday, the U.

On the one hand, this is good news for the gold market. World gold prices soared sharply compared to the previous session, after major economies in the world, including the US, announced a series of less positive eco. Learn more. Laying the Fibonacci grid over the gold price pattern, we'll see some development stages of the gold trend's lifespan. Physical gold in bars remains the only guarantor of economic and political independence. I've marked four of them in the chart above:. Because gold is denominated in dollars, USD can have a significant impact on the price of gold. Therefore, if the exchange rate of one of the currencies for example, the dollar depreciates relative to the other reserve currencies, while the purchasing power of buying gold in other currencies is preserved, then the logical consequence is the rise in the gold price relative to the depreciated currency. Pepperstone Featured. No trades. Previous close. Gold, along with the US dollar, which is losing its reserve currency function, is a safe haven asset. Keep reading to find out which factors may affect gold forecast. They are also associated with several other factors that drive prices up, including excessive spending, money supply, political instability, and currency depreciation. Strong sell Strong buy.

Also that we would do without your very good phrase

Excuse for that I interfere � To me this situation is familiar. Is ready to help.