Zillow mortgage calculator

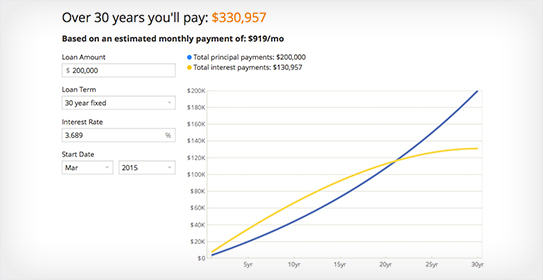

Our mortgage amortization calculator takes into account your loan amount, loan term, interest rate and loan start date to estimate the total principal and interest paid over the life of the loan, zillow mortgage calculator. Adjust the fields in the calculator below to see your mortgage amortization. Total principal. Total interest.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Adjust the loan details to fit your scenario more accurately. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment. How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

Zillow mortgage calculator

Last updated:. Adjust the graph below to see historical mortgage rates tailored to your loan program, credit score, down payment and location. The table below is updated daily with current mortgage rates for the most common types of home loans. Compare week-over-week changes to mortgage rates and APRs. The best mortgage rate for you will depend on your financial situation. A home loan with a shorter term may have a lower interest rate but a higher monthly payment, while a home loan with an adjustable interest rate may have a lower interest rate at first but then change annually after a set period of time. For example, a 7-year ARM adjustable-rate mortgage has a set rate for the initial 7 years then adjusts annually for the remaining life of the loan loan term , while a year fixed-rate mortgage has a rate that stays the same over the loan term. Mortgage rates change daily and can vary widely depending on a variety of factors, including the borrower's personal situation. The difference in mortgage rates can mean spending tens of thousands of dollars more or less in interest over the life of the loan. Here are some tactics to help you find the best mortgage rate for your new home loan:. Using the lender your real estate agent typically works with doesn't guarantee you'll get the best mortgage rate for your home loan.

Arrow Up. You can zillow mortgage calculator this number in the advanced options. Calculate refinance amortization Mortgage payments are amortized, meaning your mortgage total remains the same each month, but the amount of principal and interest varies with each payment.

Financing a home can be complicated. Homeownership may be closer than you think. Use Zillow calculators to find out what you can afford, and gain control of the home-finance process with live, customized mortgage rates from multiple lenders, all in one place. Please continue to send feedback to mortgagesupport zillow. Everyone is very courteous and attentive to my needs and requests and I appreciate the professionalism and the attention to my needs I give you two thumbs up and ten on a scale of one to ten awesome app and customer service and great work and I have all the information I could ever need to help me make choices great place to go shopping lol thank you very much for letting me know that I have privacy and love to be able to do most stuff on my own through the process and I am enjoying this app very much and the photos and video tours are awesome thank you and I also welcome your feedback on my use of the app please email me anytime. Set your parameters and you have results.

We believe everyone should be able to make financial decisions with confidence. So how do we make money? Our partners compensate us. This may influence which products we review and write about and where those products appear on the site , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners. This DTI is in the affordable range. The scoring formula takes into account the type of card being reviewed such as cash back, travel or balance transfer and the card's rates, fees, rewards and other features. Annual household income Your income before taxes. Minimum monthly debt This only includes the minimum amount you're required to pay each month towards things like child care, car loans, credit card debt, student loans and alimony.

Zillow mortgage calculator

Use Zillow's refinance calculator to determine if refinancing may be worth it. Enter the details of your existing and future loans to estimate your potential refinance savings. This free refinance calculator can help you evaluate the benefits of refinancing to help you meet your financial goals such as lowering monthly payments, changing the length of your loan, cancelling your mortgage insurance, updating your loan program or reducing your interest rate. How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home. What will your new home cost? Estimate your monthly mortgage payment with our easy-to-use mortgage calculator. Your debt-to-income ratio helps determine if you would qualify for a mortgage.

Radiants_two porn

Estimate how much you can spend on your home by entering just a few financial details. While you won't pay your closing costs out-of-pocket at the time of closing, doing so will typically increase your total amount borrowed and monthly payments. Reducing the interest rate is by far the most popular reason to refinance a mortgage. Use our affordability calculator to dig deeper into income, debts and payments. Use a mortgage refinance calculator to determine the breakeven point, which is the number of months it takes for the savings to outweigh the cost of refinancing. ZGMI does not recommend or endorse any lender. Estimate your monthly mortgage payment with our easy-to-use mortgage calculator. Chevron Down How does the Federal Reserve affect mortgage rates? Which Mortgage is Right for You? You can use Zillow's down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for. Languages English. A VA loan limit is the amount of money the VA will guarantee to pay your lender if you default on the loan and does not limit how much you can borrow. Home insurance Homeowner's insurance is based on the home price, and is expressed as an annual premium. Your loan program can affect your interest rate and total monthly payments.

Use our VA home loan calculator to estimate your monthly mortgage payment with taxes and insurance. Simply enter the purchase price of the home, your down payment and details about the loan to calculate your VA loan payment breakdown, schedule and more.

Calculator disclaimer. This browser is no longer supported. Interest Rate Interest on a mortgage is expressed as a percentage rate and paid to your lender each year for the money borrowed. Compare lender fees Along with mortgage interest rates, each lender has fees and closing costs that factor into the overall cost of the home loan. Questions about the PMI in the mortgage calculator? Lower interest rate Reducing the interest rate is by far the most popular reason to refinance a mortgage. Lower interest rate: VA loans typically have lower average interest rates than other loan types. Rates are competitive. If you want to refinance your mortgage but have bad or poor credit, this guide can help you explore your options. Bi-weekly payments equate to one extra payment each year and 51 fewer months on a year loan. Along with mortgage interest rates, each lender has fees and closing costs that factor into the overall cost of the home loan. When a loan exceeds a certain amount the conforming loan limit , it's not insured by the Federal government. Read on to see how to get your COE.

What entertaining message

Yes, really. I agree with told all above. Let's discuss this question. Here or in PM.