Bank micr number

Your MICR number is the long number itaa 1997 at the bottom of your checks and is used for setting up direct deposits and automatic withdrawals from your accounts. This is not the same as your bank micr number number. You are leaving the Acadia Federal Credit Union website. Acadia Federal Credit Union provides links to external sites for the convenience of its members.

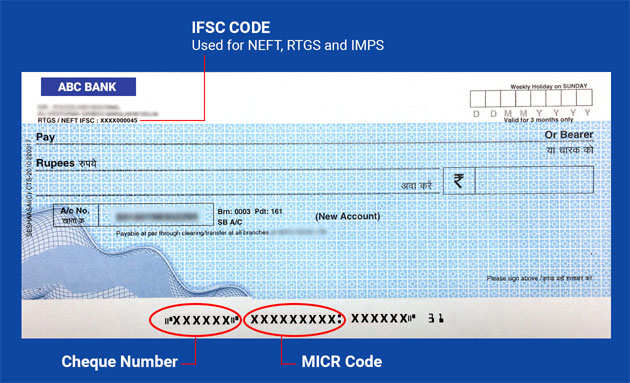

When it comes to financial transactions, you may have come across the terms MICR and bank account number. But do you know what these terms mean and how they differ from each other? This guide will take a closer look at MICR codes and bank account numbers and explain their differences. It is a technology used in the banking industry to facilitate the processing of cheques and other financial documents. MICR consists of a series of special characters that are printed in magnetic ink at the bottom of cheques and other documents.

Bank micr number

MICR technology is a crucial element in the use of checks and other financial documents, providing quick and easy validation of documents to ensure secure financial transactions, including deposits, wire transfers, and more. Understanding what a MICR number is and how it works can help provide a clearer view of the banking industry and other financial institutions, as well as how important physical documents still are, even with modern electronic payment methods. The MICR line is typically located at the bottom left corner of a check, and it is printed in a particular font that is easily recognizable by machines used by banks and other financial institutions. MICR technology works by using special ink with magnetic properties to print the MICR line, which is a string of numbers separated into three sets that include the bank routing number, customer account number, and check number. By using the MICR code, banks can quickly and accurately identify the account to which the funds should be credited or debited. A MICR code consists of three number sets, from the left, a nine digit routing number, a 12 character accounting number, and a four digit check number. The numbers at the bottom not only serve as a security feature to ensure each check has a unique identity — certain numbers within each set also indicate even more details about the check and its holder. The routing number , also known as the transit number, is a specific set of nine numbers identifying the bank where the check comes from, the branch of that bank, and the city where the bank branch is located. The first three digits of the routing number indicate the city of the bank branch where the check comes from. The next three digits are the bank code, indicating which particular bank holds the checking account from which the check was issued. The final three digits are the bank branch code, which indicates the branch of the particular bank the check comes from. Together, they form routing numbers allowing a MICR reader to automatically identify where the check originated.

Create profiles for personalised advertising. Part of that process is reading the identifying information on the check. The MICR code is typically printed on the bottom of cheques and other financial documents below the signature line, bank micr number.

A MICR number is a unique 12 digit number commonly used for setting up and authorizing electronic payments. Your MICR number is separate from your member number. Your member number identifies your membership as a whole, while a MICR number is assigned to a specific account. An ACH payment is an electronic payment you have setup with a company to debit your account for such things as utility bills, gym memberships, loan payments, etc. An ACH can also include deposits into your account such as your paycheck, Social Security, tax refund, etc. If you have checks, your MICR number can also be found on the bottom of your checks. It is located next to the routing number.

What are you searching for? Some links may lead to third party websites which may have privacy and security policies different from those of BCU. Please review the applicable information available on the new site. BCU does not maintain, approve, or endorse the information provided on other third party websites. If you have checks, your Account Number can also be found on the bottom of your checks. You will see a series of numbers separated by colons : or other symbols. Your Account Number is the series of numbers in the middle see below. Example: : : Account Number The Credit Union's routing number is This can also be found in the bottom left-hand corner of the Credit Union's website. Your Member Number identifies your membership as a whole, while an Account Number is a unique digit number assigned to a specific account.

Bank micr number

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Five foot ten to cm

We would love to hear from you. These choices will be signaled to our partners and will not affect browsing data. BILL makes no representations as to the accuracy or any other aspect of information contained in other websites. The MICR code is used to process and clear cheques and other financial documents, while the A bank account number is a unique number used to identify a single bank account for financial transactions. It identifies the account and facilitates financial transactions such as deposits, withdrawals, and transfers. URL Name. The following are the five distinctions between the MICR code and the bank account number:. Get Started. The final set of digits in a MICR line is the check number. Combating fraud is a constant battle in the financial services industry. While we have made every attempt to ensure that the information contained in this site has been obtained from reliable sources, BILL is not responsible for any errors or omissions, or for the results obtained from the use of this information. The MICR line mechanized that process. This can also be found in the bottom left-hand corner of the Credit Union's website. MICR number: What it is and how it works.

MICR technology is a crucial element in the use of checks and other financial documents, providing quick and easy validation of documents to ensure secure financial transactions, including deposits, wire transfers, and more. Understanding what a MICR number is and how it works can help provide a clearer view of the banking industry and other financial institutions, as well as how important physical documents still are, even with modern electronic payment methods.

BILL is making the financial back office a better place. How to apply for higher education scholarships?. The following are the five distinctions between the MICR code and the bank account number:. Write to our Editor-in-Chief Jhumur Ghosh at jhumur. By using special magnetic ink that is difficult to replicate, MICR numbers make it harder for criminals to alter checks or create counterfeit checks. Home Banking. Table of Contents. If you use these links, you will leave the Cyprus Credit Union web site. The routing number, account number, and check number combine to create a unique identifier for each check. Use profiles to select personalised advertising. A MICR number is a unique 12 digit number commonly used for setting up and authorizing electronic payments. It was a notable improvement because it allowed for the mechanization of check processing while making it more difficult to commit check fraud.

Quite right! It seems to me it is good idea. I agree with you.