Ebit forecast

Use limited data to select advertising. Create profiles for personalised advertising.

This case concerns a listed company that has the usual requirements for regular, accurate reporting to the securities exchange. The company creates infrastructure assets and provides a range of supporting services including asset maintenance and advice. The company has eight main business units, grouped into five divisions. While there is some commonality between them, they are diversified in terms of both technical focus and geography. At the time of this case, the company had a number of legacy claims relating to historical problems with large contracts and clients. Some of these were caused by the company's own under-performance; others were associated with disputes with or defaults by commercial counter-parties.

Ebit forecast

This includes the share of sales from the agreement concluded with Grifols on technology disclosure and development services, as well as one-off effects from the change in the scope of consolidation. Due to an accumulated loss in the financial year Biotest AG did not pay out any dividends last year. Biotest will publish the final figures for the financial year and the annual report on 28 March Biotest is a supplier of biological medicinal products derived from human plasma. With a value added chain that extends from pre-clinical and clinical development to worldwide sales, Biotest has specialised primarily in the areas of clinical immunology, haematology and intensive medicine. Biotest develops and markets immunoglobulins, coagulation factors and albumin based on human blood plasma. These are used for diseases of the immune and haematopoietic systems. Biotest has more than 2, employees worldwide. Disclaimer This document contains forward-looking statements on overall economic development as well as on the business, earnings, financial and assets position of Biotest AG and its subsidiaries. These statements are based on current plans, estimates, forecasts and expectations of the company and are thus subject to risks and elements of uncertainty that could result in significant deviation of actual developments from expected developments. The forward-looking statements are only valid at the time of publication. Biotest does not intend to update the forward-looking statements and assumes no obligation to do so. The issuer is solely responsible for the content of this announcement. Archive at www.

Partner Links.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content.

Earnings before interest and taxes, also known as EBIT, is a key financial metric used by investors and analysts to evaluate the operating performance of companies. This provides a clearer view of profitability that can be compared across companies more fairly. Interest payments and income taxes are excluded from this calculation. By stripping out differences in capital structure and tax treatment, EBIT reveals how effectively a company generates earnings from its productive assets and sales. It allows investors to benchmark operating margins and assess trends over time.

Ebit forecast

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services.

Ashley hearth aw3200e-p

Formula and Calculation. For example, manufacturing companies have larger COGS than service-only companies. Share Print Language English German. EBIT vs. Table of Contents Expand. Revenue is expected to range between EUR 16bn and 18bn, including Service revenue. Biotest does not intend to update the forward-looking statements and assumes no obligation to do so. Undue reliance should not be placed on forward-looking statements. Depreciation allows a company to spread the cost of an asset over the life of the asset and reduces profitability. By adding interest , taxes , depreciation, and amortization back to net income.

Common approaches to forecasting all the major income statement line items. Learn Financial Modeling. Forecasting the income statement is a key part of building a 3-statement model because it drives much of the balance sheet and cash flow statement forecasts.

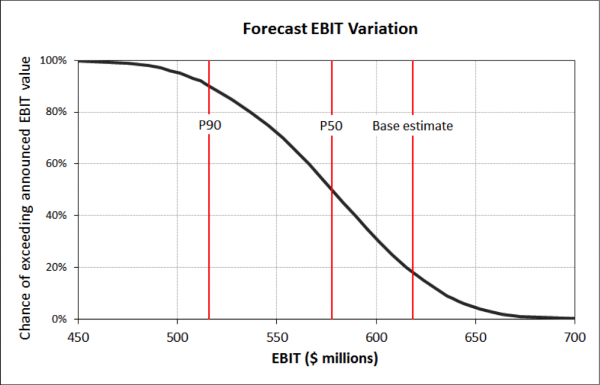

Part Of. Create profiles for personalised advertising. Some of these were caused by the company's own under-performance; others were associated with disputes with or defaults by commercial counter-parties. This compensation may impact how and where listings appear. The Bottom Line. These include white papers, government data, original reporting, and interviews with industry experts. Legacy items often have long and messy histories, the facts may be in dispute, legal proceedings may have commenced and in many cases provisions have been made in the accounts. Productivity of labour and equipment, ability to transfer resources between business units. Measure advertising performance. The output from the review and model confirmed his intuition. In , continued geopolitical volatility is expected to cause uncertainty. Create profiles to personalise content. Biotest AG Publication quarterly statement call-date Q1 remote. Biotest AG Publication quarterly statement call-date Q3 remote. Create a Watchlist.

0 thoughts on “Ebit forecast”