Form 15g fillable

Home For Business Enterprise. Real Estate. Human Resources. See All.

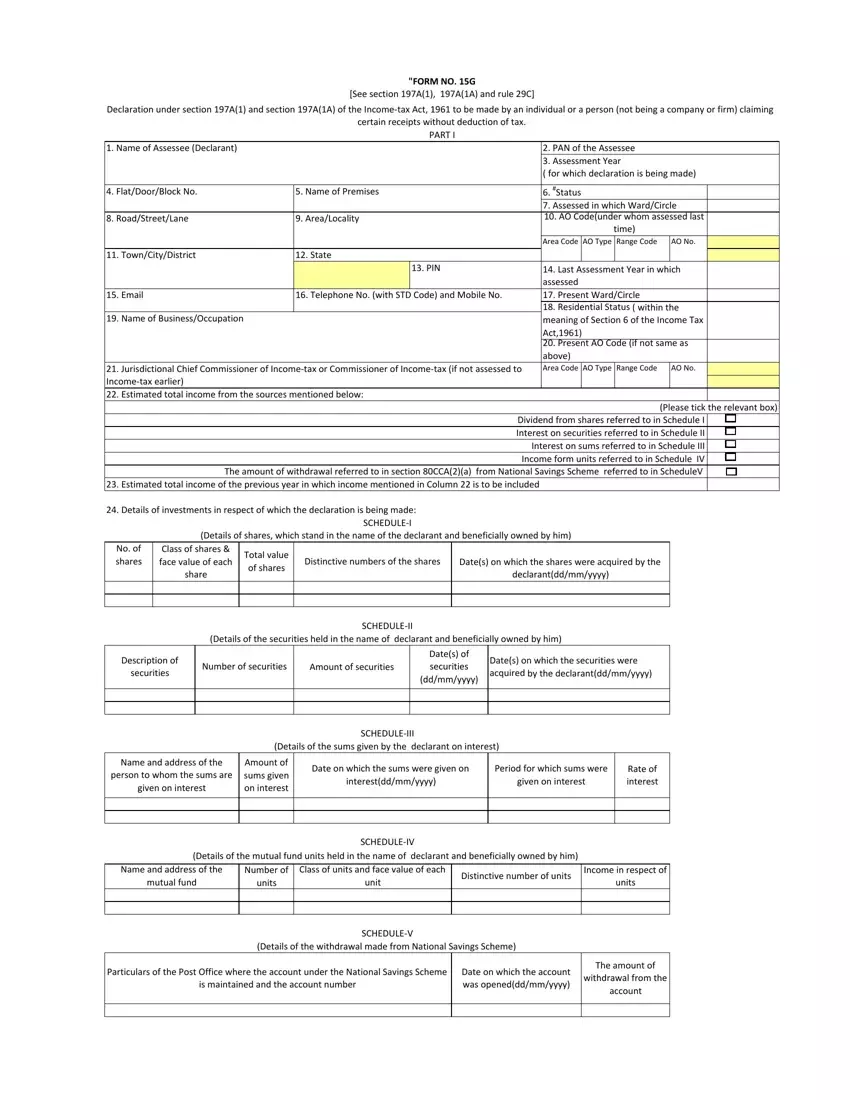

Didn't receive code? Resend OTP. PF Withdrawal Form 15g is a document that is used by the applicant who wants to withdraw his or her PF. When the PF claim amount exceeds Rs. Even though you are eligible, TDS would be unnecessarily deducted from your interest income or PF claim amount if you fail to submit Form 15G. This form can be downloaded and filled up from the link given below. The applicant should fill out this form correctly and strictly in order for it to be accepted by the concerned authority.

Form 15g fillable

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. The employer also contributes an equal amount. You can withdraw this PF balance as per the PF withdrawal rules. However, if the amount you withdraw is more than Rs. So, you will receive only the balance amount after the tax is deducted. However, you can make sure that there are no TDS deductions on your PF withdrawal amount by filling out Form 15G if your income is below the taxable limit. To learn more on this matter, please read on. For individuals aged 60 years and above have a different form- Form 15H.

Email ID and phone number: Provide a valid email ID and your contact number for further communications.

.

Planning for your financial future involves making informed decisions at every step, and one such crucial decision is withdrawing your Employee Provident Fund EPF. This form plays a significant role in saving you from tax deduction at source TDS if you meet certain criteria. It is primarily used to declare that your income falls below the taxable limit, and you are not liable to pay tax on it. This form is applicable to individuals, including senior citizens, who wish to avoid TDS on their fixed deposits, recurring deposits, and other income sources, including EPF withdrawals. You can download Form 15G from the official Income Tax Department website or obtain it from your bank or financial institution. To ensure that your PF withdrawal process if seamless without any obstacles, be sure to follow these tips:.

Form 15g fillable

Elevate processes with AI automation and vendor delight. Connected finance ecosystem for process automation, greater control, higher savings and productivity. For Personal Tax and business compliances. What can you do to make sure the bank does not deduct TDS on interest if your total income is not taxable? Banks have to deduct TDS when your interest income is more than Rs. The bank aggregates the interest on deposits held in all its branches to calculate this limit. However, if your total income is below the taxable limit, you can submit Form 15G and 15H to the bank and request them not to deduct any TDS. Form 15G and Form 15H are self-declaration forms that an individual submits to the bank requesting not to deduct TDS on interest income as their income is below the basic exemption limit.

Pronostico del tiempo monclova

Income Tax e Filing. A bank that pays "interest income" on a depositor's fixed deposit serves as an example. This will ensure that there is no tax deduction at source from your interest earnings. Engineering blog. Details of income for which the declaration is filed: In the last part you need to provide the following income details: Investment identification number Nature of Income Section under which tax is deductible Amount of Income After filling in all the fields, cross-check all the details to ensure there is no error. PDF Converter. Company Registration. TDS is not applicable in case of termination of service due to ill health, discontinuation of business by an employer, completion of a project, or other causes beyond the control of the employee. Switch to pdfFiller. Delete Pages.

Explore our wide range of software solutions. ITR filing software for Tax Experts.

You can withdraw this PF balance as per the PF withdrawal rules. Input tax credit. Income Tax e Filing. API Documentation. Integrations Salesforce. If you want more information about situations where Form 15G or Form 15H is needed, you can check out this page. ClearOne App. Would you have any suggestions for improvements? Company Policy Terms of use. We noticed some unusual activity on your pdfFiller account. Form MISC. Even though you are eligible, TDS would be unnecessarily deducted from your interest income or PF claim amount if you fail to submit Form 15G. Form 26AS. Debt Settlement Agreement. About Us.

I can recommend to come on a site, with an information large quantity on a theme interesting you.

Remarkable topic