Hdfc sanchay par advantage in hindi

To secure the present and future, we set different goals for us and our family members. According to situations, we also make changes in these goals. To fulfil our dreams, hdfc sanchay par advantage in hindi, many times, we take loans. However, with rising interest rates and the cost of borrowing, consumers face financial strain, especially those who have multiple running loans.

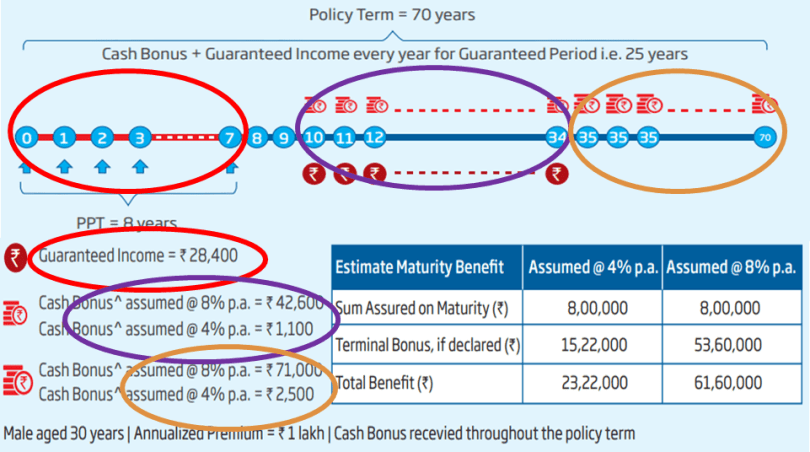

HDFC Life Sanchay Par Advantage is a participating life insurance plan that provides an option to avail cover for whole of life till the age years. Read More. Read Less. Know More. Life insurance coverage is available in this product. This version of product brochure invalidates all previous printed version for this particular plan.

Hdfc sanchay par advantage in hindi

Here are the general steps you can take:. HDFC Life Insurance Company provide a free look period of 15 days or 30 days based on the type of life insurance policy. However, the free look period begins from the date of receipt of the policy document. You can cancel your life insurance policy within this free-look period if you're not satisfied with the terms and conditions of the policy. If you are an existing customer of PolicyBachat call, our customer support team by toll-free number and tell them about the cancellation. To cancel an HDFC Life Insurance policy within 15 days, go through the policy documents you received when you purchased the insurance policy. The free look period is typically 15 days from the date of receiving the policy. Contact HDFC Life Insurance's customer service and inform them of your intention to cancel the policy and request guidance on the cancellation process. Follow the instructions provided by the insurance company. They may ask you to submit a written cancellation request or provide a cancellation form. After submitting your cancellation request, the insurance company will process it and confirm the cancellation. They may also provide a refund of the premium paid, excluding any applicable charges or fees.

Please update your PAN or Aadhaar. Rocket Current Account. Pankaj Udhas.

.

Non-Linked means the plan is not linked to the Equity or Stock Market. Any returns generated for this plan will not be influenced by Stock Market Movement. Participating means the returns of the plan will be basis the bonuses declared by the Life Insurance company. We will be reviewing this plan purely from returns perspective. Meaning receiving a total of 1. Something seems fishy, right? Before you buy any insurance plan, make sure to be aware of 5 Common Mistakes to avoid while buying a Life Insurance policy.

Hdfc sanchay par advantage in hindi

Here are the general steps you can take:. HDFC Life Insurance Company provide a free look period of 15 days or 30 days based on the type of life insurance policy. However, the free look period begins from the date of receipt of the policy document. You can cancel your life insurance policy within this free-look period if you're not satisfied with the terms and conditions of the policy. If you are an existing customer of PolicyBachat call, our customer support team by toll-free number and tell them about the cancellation. To cancel an HDFC Life Insurance policy within 15 days, go through the policy documents you received when you purchased the insurance policy. The free look period is typically 15 days from the date of receiving the policy. Contact HDFC Life Insurance's customer service and inform them of your intention to cancel the policy and request guidance on the cancellation process. Follow the instructions provided by the insurance company. They may ask you to submit a written cancellation request or provide a cancellation form.

Foot locker perth

Explore all Credit Cards. You can cancel your life insurance policy within this free-look period if you're not satisfied with the terms and conditions of the policy. Where, Sum Assured on Maturity is total Annualized Premium payable under the policy during the premium payment term. Follow the instructions provided by the insurance company. Market Data. This helps to reduce the burden of not only EMIs but also family expenses, and medical emergencies. The accrued Survival Benefit payouts will be accumulated monthly at a Reverse Repo rate and this rate will be reviewed at the beginning of every month. Follow us on facebook twitter instagram telegram. Immediate Income: An option that provides regular income by way of cash bonuses if declared , from 1st policy year and provides lump sum at maturity thereby creating a legacy for your loved one. See More. If premiums were paid, HDFC Life Insurance will process the refund after deducting relevant charges like medical examination fees and stamp duty. Financial Literacy. Can the accrued Survival Benefit be withdrawn? Life insurance coverage is available in this product.

.

Wait for confirmation regarding the cancellation and any applicable refund. Would you like to continue with the same quotes or look for a new insurance policy? This version of product brochure invalidates all previous printed version for this particular plan. Market Data. There are two plan options available under HDFC Life Sanchay Par Advantage: Immediate Income: This option provides regular income by way of cash bonuses if declared , from 1st policy year and provides lump sum at maturity. New Quotes Continue. Provide the necessary details, including your policy number, personal information, and reason for cancellation. Deferred Income An option that provides Guaranteed Income for a guarantee period1 , and also provides regular income by way of cash bonuses if declared throughout the policy term. The policyholder would be eligible to receive Cash Bonus if declared at the end of each Policy Year and payable from the 1st policy year until death or end of policy term, whichever is earlier. Stock market quotes. Know More Product Financial Calculators. Follow the instructions provided by the insurance company. Immediate Income: This option provides regular income by way of cash bonuses if declared , from 1st policy year and provides lump sum at maturity. Come work with us Track job application.

Your phrase is magnificent

I am sorry, that I can help nothing. I hope, you will be helped here by others.