Jhu tax office

It is very important for international students and scholars to understand their U.

Wednesday: a. Tuesday and Thursday: p. Building Financial Fitness Webinars. Recording is linked above and the slide deck can be found here. Contact information for each speaker is found in the description of the video.

Jhu tax office

View more. The institution is comprised of approximately 6, faculty, 6, undergraduate students and 25, graduate students across degree programs at the baccalaureate, master's and doctoral levels. The mission of the university is to educate its students and cultivate their capacity for lifelong learning, to foster independent and original research, and to bring the benefits of discovery to the world. The Tax Office is responsible for all the institution's domestic and international tax matters and is an integral member of this high-performing, client-focused team. Johns Hopkins offers a total rewards package that supports our employees' health, life, career and retirement. Please refer to the job description above to see which forms of equivalency are permitted for this position. If permitted, equivalencies will follow these guidelines: JHU Equivalency Formula: 30 undergraduate degree credits semester hours or 18 graduate degree credits may substitute for one year of experience. Additional related experience may substitute for required education on the same basis. The successful candidate s for this position will be subject to a pre-employment background check. Johns Hopkins is committed to hiring individuals with a justice-involved background, consistent with applicable policies and current practice. A prior criminal history does not automatically preclude candidates from employment at Johns Hopkins University.

Menu Publications. The jhu tax office is comprised of approximately 6, faculty, 6, undergraduate students and 25, graduate students across degree programs at the baccalaureate, master's and doctoral levels. Menu Cyber Operations.

The Johns Hopkins University is a non-profit, educational corporation incorporated in the State of Maryland. The University is responsible for complying with appropriate federal and state corporate tax laws:. Generally, the University is exempt under IRS code section c 3 from federal and state income tax. However, certain activities may result in unrelated business income which is subject to federal and state income tax. Generally, the University is exempt from state sales tax on purchases. The University collects state sales tax on sales of goods in states where the University is required to collect sales tax.

If you have any questions about the benefits available to you, you can contact the Benefits Service Center by email, or by phone from a. Phone: Email: benefits jhu. Benefits: For all benefits questions, contact the Benefits Service Center at or benefits jhu. Employee Self-Service ESS : Access all your pay information and make changes to your address, tax withholding, and other information. Go to ESS. If you need further assistance contact or HRBusinessServices jhu. Organizational Development: Questions about our Organizational Development offerings can be directed to orgdevelopment jhu. Position Classification: For support related to positions on the East Baltimore campus, email comp-healthsciences jhu. For support related to all other positions at the university, email comp-jhucentral jhu.

Jhu tax office

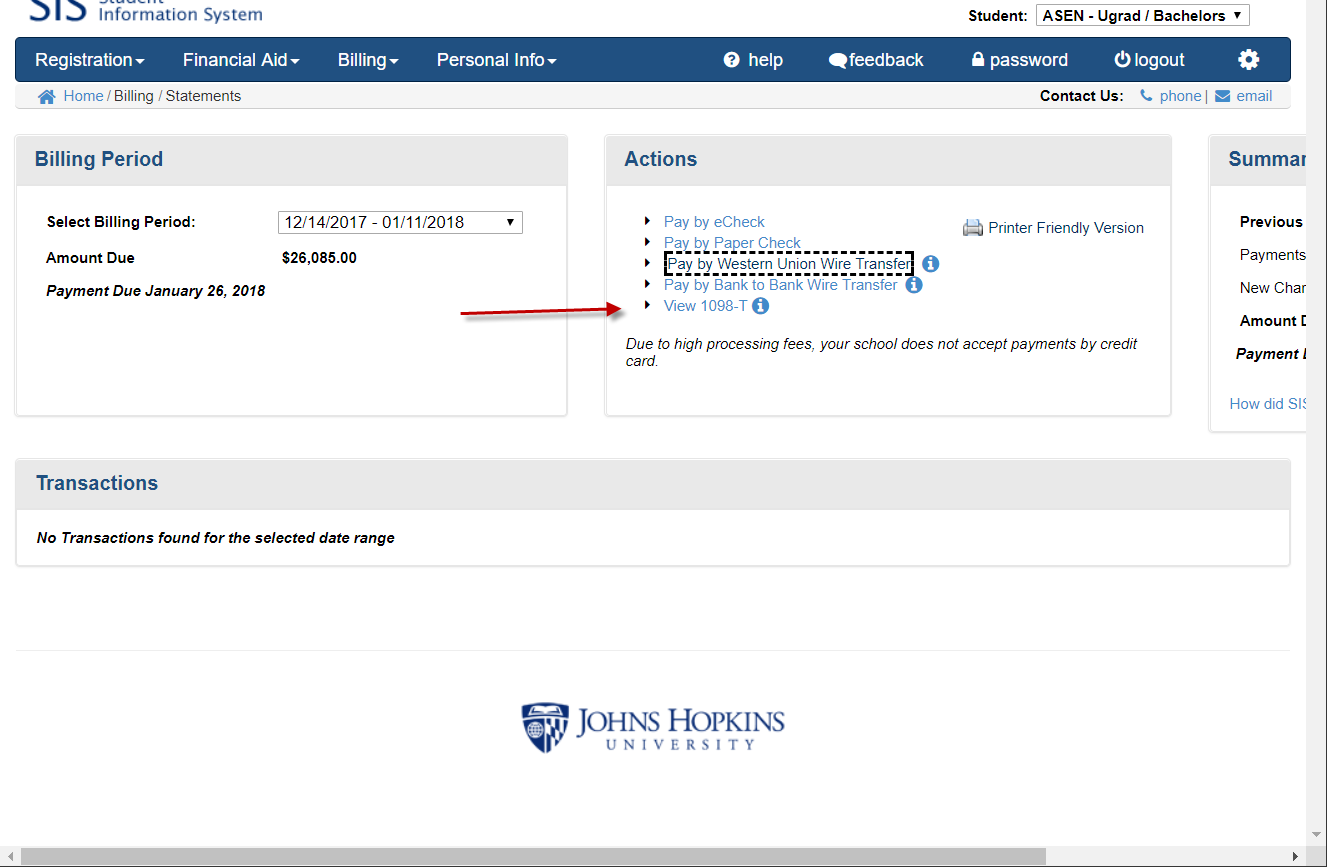

It is very important for international students and scholars to understand their U. The JHU Tax Office provides some support and resources to international students and scholars regarding taxes, including the facilitation of tax treaties. The JHU Tax Office does not provide personal tax advice to any individuals, international or domestic. Monday April 15, is the tax filing deadline for residents and nonresidents who earned U. Starting in tax returns , the University has partnered with Sprintax to provide an easy-to-use tax preparation software designed for nonresident students and scholars in the U. The Sprintax software is made available by JHU to all of its nonresident students, scholars, faculty, staff and researchers. Use of Sprintax for federal tax filings is free, and state tax filings are available for a small fee.

Faber chimney store near me

The JHU Tax Office does not provide personal tax advice to any individuals, international or domestic. Menu Barry Grabow. Directs worker classification determinations. Exceptions to the COVID and flu vaccine requirements may be provided to individuals for religious beliefs or medical reasons. Menu Resources for Retirees. Menu Miguel Agramonte. Menu Kirk Shawhan. Menu Vendor Forms. Menu Diversity, Equity, and Inclusion. Graduate students, trainees and other JHU affiliates are encouraged to visit the food pantry on the Homewood Campus if they are experiencing food insecurity. Menu Recruiting Events. Menu Jason Kalirai. The University is responsible for complying with appropriate federal and state corporate tax laws:. Menu Awards and Recognition. Johns Hopkins offers a total rewards package that supports our employees' health, life, career and retirement.

University Finance is collectively responsible for developing and implementing strategic planning, policies, and programs to provide the highest quality of services and support for our customers.

Menu Controlled Items Policy. For more information: email hopkinspantry gmail. We have access to Hopkins Perks at Work for various discounts including travel, electronics, and restaurants. Excellent interpersonal skills and the ability to relate effectively with a wide range of individuals and constituencies in a diverse community. Additional education may substitute for required experience, to the extent permitted by the JHU equivalency formula. The Tax Office is responsible for all the institution's domestic and international tax matters and is an integral member of this high-performing, client-focused team. The link to the recording and the slides used for the presentation section are found below. Monday April 15, is the tax filing deadline for residents and nonresidents who earned U. All questions should be sent to the general Tax Office email tax jhu. To access your account, Login here and send any questions to help glaciertax. Menu Gina Ellrich. Blood tests for immunities to these diseases are ordinarily included in the pre-employment physical exam except for those employees who provide results of blood tests or immunization documentation from their own health care providers.

Many thanks for the information. Now I will know it.

It is remarkable, rather useful message

Yes, you have truly told