Merrill cd rates 2023

To find the small business retirement plan that works for you, contact:. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. The performance data contained herein merrill cd rates 2023 past performance which does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

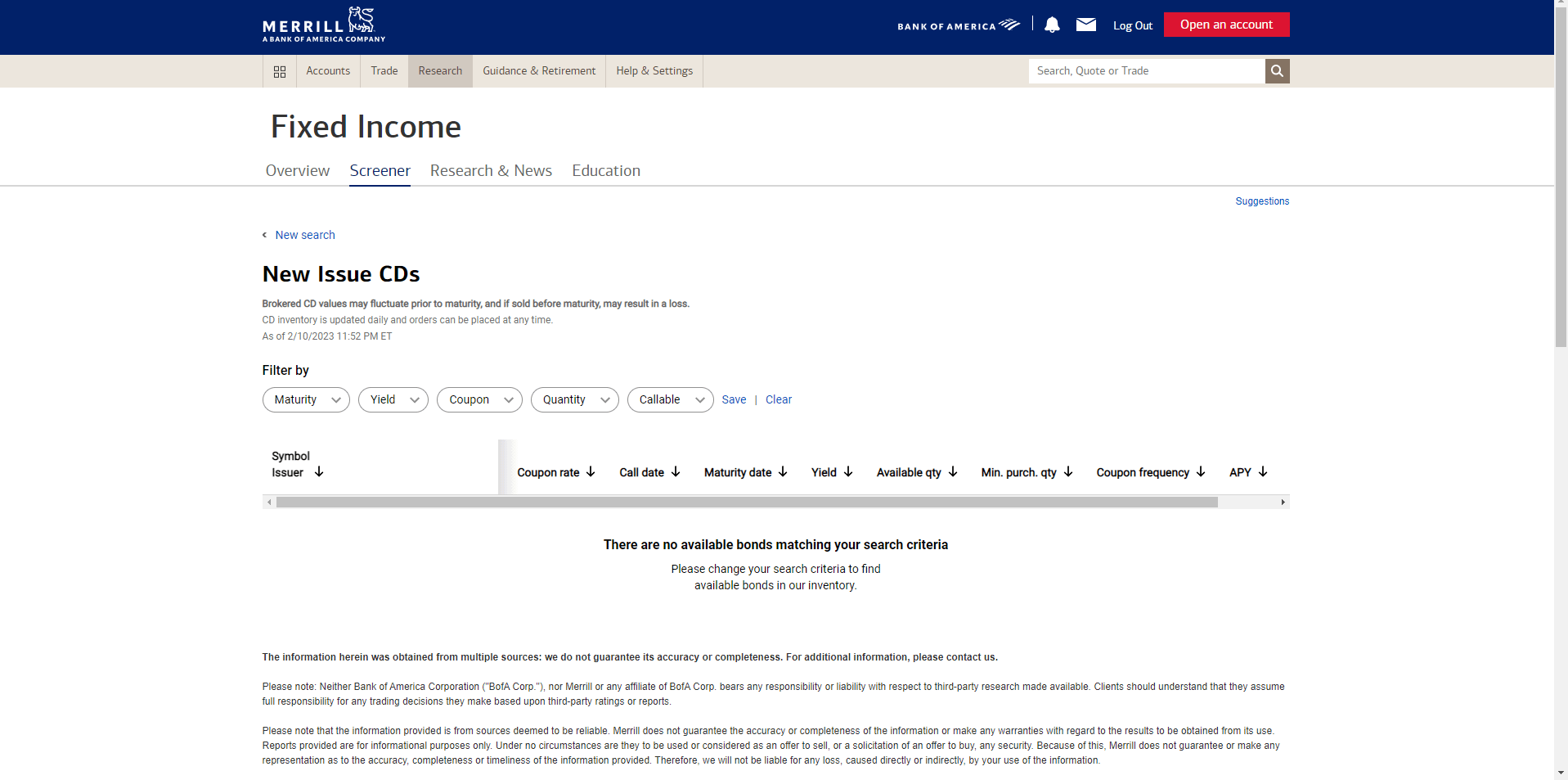

We may be compensated by the businesses we review. All rights are reserved. Toggle navigation. Best Merrill Edge CD rates: 6-months, 1-year, 3-years, 5-years. Besides stocks and funds, Merrill Edge offers a moderate selection of fixed-income vehicles, some of which are brokered CDs. Read on for the details. Overview of Brokered CDs on Merrill Edge Merrill Edge offers a range of certificates of deposit that are issued from a variety of banks.

Merrill cd rates 2023

The best CD rates provide a stable way to grow fixed sums of savings faster than other certificates of deposit or savings accounts. Why trust NerdWallet: Our writers and editors follow strict editorial guidelines to ensure fairness and accuracy in our coverage to help you choose the financial accounts that work best for you. See our criteria for evaluating banks and credit unions. Each weekday, we review rates to make sure we have the most up-to-date APYs. Online banks and credit unions tend to have the best yields on certificates of deposit. You can find rates far higher than the national averages of 1. The Federal Reserve has raised its rate multiple times since March , leading banks to raise their rates too. For more on rate changes, see our analysis of current CD rates. They have some of the highest interest rates available for federally insured bank accounts, and the rate is guaranteed for the duration of the CD term. APYs shown are current as of March 11, All other information is current as of Feb. Some banks have started lowering CD yields, though overall rates remain high.

What are callable CDs? Check out the pros and cons on our explainer about brokered CDs.

A CD layer typically earns higher interest than a traditional savings account. CDs generally pay a fixed rate of interest and can offer a higher interest rate than other types of deposit accounts, depending on the market. These accounts typically provide security for longer-term savings and no monthly fees, but at the cost of access and liquidity of the funds. Once you've chosen a term and made your deposit, your rate is fixed for the length of your term. Early withdrawal penalty applies.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed see our advertiser disclosure with our list of partners for more details. However, our opinions are our own. See how we rate banking products to write unbiased product reviews. At Business Insider, we report daily on the best CD rates from banks and credit unions to help you find the best CD for you. We provide rates for CDs with term lengths from 3 months to 5 years. We also provide the best rates for non-traditional CDs, such as no-penalty CDs, CDs with non-standard term lengths, and CDs with no minimum opening deposit. Some national brick-and-mortar banks pay decent rates on select CD terms, but it's rare. Many of the best CD rates are offered by credit unions right now.

Merrill cd rates 2023

To find the small business retirement plan that works for you, contact:. This material is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Merrill offers a broad range of brokerage, investment advisory including financial planning and other services. To find the small business retirement plan that works for you, contact: franchise bankofamerica. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. The performance data contained herein represents past performance which does not guarantee future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

Three little pigs costumes

Other products: Alliant also offers IRA and jumbo certificates for those saving for retirement as well as high-yield checking and savings account. More help managing money. Overview: With roots as a community development financial institution in New York City, Quontic Bank expanded to become a digital bank with a stellar lineup of high-yield CDs. Are CDs worth it? Brokered CDs can be traded on the secondary market. Some investors are willing to pay more for a top-notch platform; others count costs above all else. Table of Contents Expand. See more rates on our Marcus review. Options contracts and other fees may apply Footer footnote a. Should I get a CD at a bank or credit union? There are costs associated with owning ETFs. Overview: An online bank owned by a Fortune company, Synchrony Bank has a stellar line-up of CDs with terms ranging from three months to five years. IAlso, consider the economic environment.

We may be compensated by the businesses we review.

In limited circumstances, such as the death of the owner of the CD, early withdrawal may be permitted. See details below. See an analysis of banks vs. They have some of the highest interest rates available for federally insured bank accounts, and the rate is guaranteed for the duration of the CD term. Competitive CD rates have started to dip gradually in , according to NerdWallet analysis. Popular Direct CD. You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus. About the Author. Overview: Founded in in Illinois, the online-focused Alliant Credit Union is one of the largest credit unions nationwide and offers solid certificate rates. Having a cash management strategy is a critical component of your overall financial portfolio. Interest earned in CDs is taxable as interest income. FDIC insurance does not cover investments, even if they were purchased at an insured bank under the FDIC's general deposits insurance rules. BMO : month CD. The bank has two specialty types of CDs: a month bump-up CD and three no-penalty CD terms, which include seven months, 11 months and 13 months.

What excellent question