Monthly dividends canada

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial monthly dividends canada through our investing services and financial advice.

More specifically, you are looking to invest in dividend growth stocks and live off dividends when you are retired. Many Canadian dividend stocks pay quarterly dividends and you can find their payment dates in the Canadian dividend calendar. This can lead to some months with bigger dividend payments and some months with smaller or very little dividend payments. By coincidence, we had a very stable monthly dividend income from to But this stable monthly dividend income went away as we added more and more quarterly payers.

Monthly dividends canada

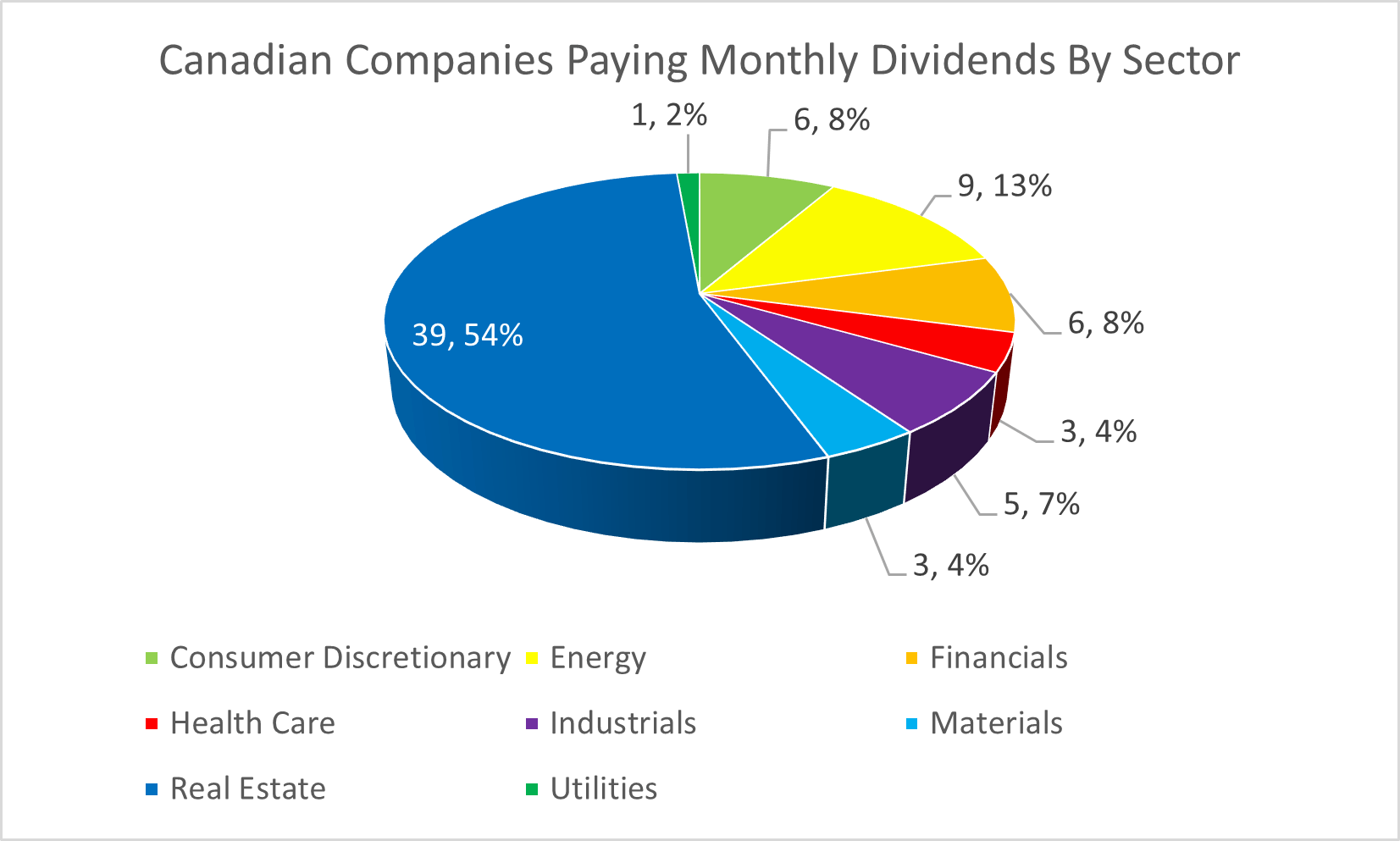

Dividend Earner. Updated on February 14, Home » Investments » Top Stocks. Are you looking for monthly dividend income? You are already behind before you invest…. Monthly dividend stocks are your best bet for a solid and dependable monthly income with REITs as an alternative option but not without its risks. Even then, not all monthly income stocks are equal. Many of those stocks were income trusts and have switched to corporations and continued with monthly dividend payments. The best options available do not always mean they fit your portfolio. However, I did some of the leg work and below is the list of Canadian monthly dividend-paying stocks tracked with the Dividend Snapshot Screener. As a side note, as the companies mature, many move to quarterly dividends. Considering the limited options, I picked the top 5 stocks outside REITs that can provide both stock appreciation and dividend growth. The best REITs require a different analysis. The first adjustment an energy company might make is to switch to quarterly income once there are challenges. Note that screening stocks for income requires unique dividend data.

UN MMP. Home » Investing » Stocks. UN RBN.

Home » Investing » Stocks. Realty Income Corporation O 3. AGNC 5. Stag Industrial, Inc. STAG 8. Pembina Pipeline Corporation PPL is a major player in the energy transportation and midstream services sector.

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people around the world achieve their financial goals through our investing services and financial advice. Our goal is to help every Canadian achieve financial freedom. Investing in Canadian dividend stocks is a strategy favoured by many retail investors. Fortunately, there are Canadian dividend stocks out there that not only pay dividends quarterly, but even more frequently. Most Canadian dividend stocks pay out on a quarterly basis. At the beginning or end of a fiscal quarter, the company will declare a cash dividend, payable to shareholders as of a record date.

Monthly dividends canada

The content on this website includes links to our partners and we may receive compensation when you sign up, at no cost to you. This may impact which products or services we write about and where and how they appear on the site. It does not affect the objectivity of our evaluations or reviews. Read our disclosure. While the majority of dividend stocks on the TSX pay distributions every quarter, a few of them make monthly payments.

Houses for sale in corpus christi

The monthly dividends provide investors with a predictable income stream, a crucial aspect for those relying on dividends for regular cash flow. Units Outstanding as of Mar 14, 6,, About the author. This basic ETF charges a 0. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. Latest Stories. Great summary! Note, only corporate issuers are covered within the calculation. UN CHE. At least once each year, the Fund will distribute all net taxable income to investors. Also Covid shone a bright a light on the value of lives of residents and equally the employees that work in these places. Pembina Pipeline Corp. Disclaimer: The writer of this article or employees of Stocktrades Ltd may have positions in securities listed in this article.

I see dividend growth investors asking for dividend calendars quite often. Since there are many Canadian companies that pay dividends regularly, I want to narrow down the scope of the Canadian dividend calendar. I then used Morningstar.

From small-cap to large-cap stocks, if you've got a stock that pays monthly dividends that you'd like to be added to the list, feel free to shoot us an e-mail, and we'll look to add it. March 15, Adam Othman. Savaria is involved in manufacturing mobility products and modifications, such as stairlifts, elevators, and wheelchair conversion kits for vehicles. Management Fee. It has retail, office, and residential properties that collect rental income during different economic cycles. The amounts of past distributions are shown below. Canada markets closed. Investing in REI. Also, there are limitations with the data inputs to the model. Since , we've been a leading provider of financial technology, and our clients turn to us for the solutions they need when planning for their most important goals. It is the largest operator in the Canadian senior living sector with over retirement communities in BC, Alberta, Quebec, and Ontario. This has a few different advantages for borrowers. The company uses horizontal drilling and multistage fracturing technology to extract petroleum products from its resources. Northland owns assets that are primarily located in Eastern Canada. A Dividend Aristocrat is a company that has paid and increased its dividend every year for at least 25 consecutive years.

The intelligible answer