Silver price prognosis

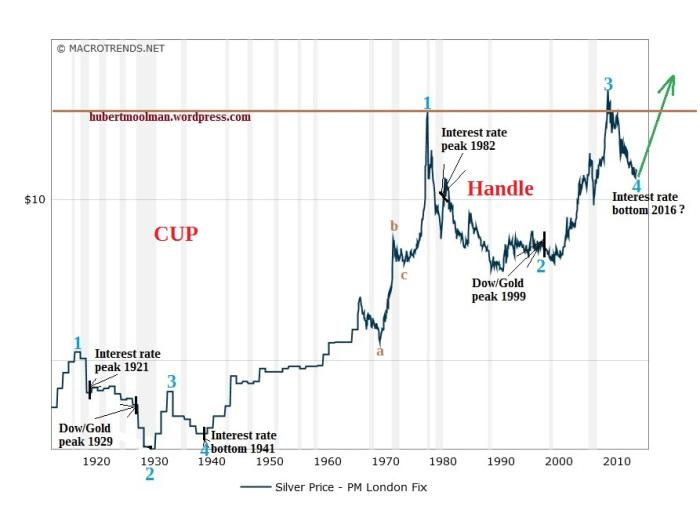

Silver will move higher in because the top in Yields is confirmed.

Price predictions help market participants manage price risks, create hedging strategies, and make informed decisions about buying or selling assets in financial markets. That said, price predictions are speculative, particularly when it comes to long-term price forecasts. Therefore, investors should use them as a complementary tool, and not as their primary source of advice to make investment or trading decisions. Together with gold, silver is one of the most popular precious metals. It has been used for many centuries to create coins and jewellery. It has also established itself as a popular investment for investors trying to protect their assets against inflation.

Silver price prognosis

Analysts forecast that the price of gold and silver will rise if the Federal Reserve cuts interest rates this year, according to a report from CNBC Sunday. Also this comes with a weaker dollar," Teves said. In January, the Federal Reserve held short-term interest rates at a year high of 5. While research has found that gold doesn't directly correlate with inflation in any meaningful way, people are likely buying more gold in an attempt to own some sense of stability in an economy that is rife with inflation, a tough real-estate market and a growing distrust for banks and other financial institutions, Jonathan Rose, co-founder of Genesis Gold Group, told CNBC. According to the investing website Investopedia, the price of gold is influenced by a number of market factors including supply and demand, interest rates, market volatility and potential risk to investors. It tends to outperform a move in gold," Teves said. So there is a lot of catching up to do and I think the move could be quite dramatic. The UBS report came after a report from the Silver Institute projected that global silver demand would increase to 1. The wholesaler has the 1-ounce bars listed for sale online but they are available only to members with a limit of two bars per member. Price of gold, silver expected to rise with interest rate cuts, UBS analyst projects. Facebook Twitter Email. Share your feedback to help improve our site!

This could be a banner year for silver, with prices potentially hitting a decade-high.

Neumeyer has voiced this opinion often in recent years. He has reiterated his triple-digit silver price forecast in multiple interviews with Kitcoover the years, as recently as March Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year , when investors were sailing high on the dot-com bubble and the mining sector was down. It was during that Neumeyer himself invested heavily in mining stocks and came out on top. In his August with Wall Street Silver, he reiterated his support for triple-digit silver and said he's fortunately not alone in this optimistic view — in fact, he's been surpassed in that optimism. Another factor driving Neumeyer's position is his belief that the silver market is in a deficit. In a May interview , when presented with supply-side data from the Silver Institute indicating the biggest surplus in silver market history, Neumeyer was blunt in his skepticism.

Washington D. Physical silver investment demand consisting of silver bar and bullion coin purchases is projected to jump 13 percent in , achieving a 7-year high. Macroeconomic and geopolitical conditions will generally support precious metals prices in the first half of this year. However, once the pace of U. The Silver Institute is pleased to provide the following insights on the major components of the silver market. In the silver market will build on the strong foundation set last year, when silver demand gained in all key sectors. The global total for is forecast to achieve a new record high, increasing by 8 percent to 1. Silver industrial offtake accounting for more than half of total silver demand is projected to strengthen further, establishing a new record high in

Silver price prognosis

Neumeyer has voiced this opinion often in recent years. He has reiterated his triple-digit silver price forecast in multiple interviews with Kitcoover the years, as recently as March Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year , when investors were sailing high on the dot-com bubble and the mining sector was down. It was during that Neumeyer himself invested heavily in mining stocks and came out on top. In his August with Wall Street Silver, he reiterated his support for triple-digit silver and said he's fortunately not alone in this optimistic view — in fact, he's been surpassed in that optimism. Another factor driving Neumeyer's position is his belief that the silver market is in a deficit. In a May interview , when presented with supply-side data from the Silver Institute indicating the biggest surplus in silver market history, Neumeyer was blunt in his skepticism. That's due to all the great technologies, all the newfangled gadgets that we're consuming.

Yellow ball gown

Electric vehicles, solar panels, windmills, you name it. As things are now, it seems unlikely silver will reach those highs. The Fed continued these small rate hikes over the next year with the last in July In his August with Wall Street Silver, he reiterated his support for triple-digit silver and said he's fortunately not alone in this optimistic view — in fact, he's been surpassed in that optimism. The first one was hit, the second one might be hit or not. A bullish reversal setup that is testing the edges. Industrial Metals. Silver's inclusion on the list would allow silver producers to accelerate the development of strategic projects with financial and administrative assistance from the Canadian government. After prices started to cool down, the Hunt brothers could not meet their margin requirements, which caused panic in the market. Readers should seek their own advice.

The latest silver price forecasts, predictions and analysis of trends in the silver market. Silver expert David Morgan provides his outlook for silver in , including the main catalysts he sees driving demand. David also discusses platinum, palladium, copper, and other commodities he thinks will outperform as we move into the New Year.

Why is silver so cheap? In that vein, silver is more sensitive to economic changes and more volatile than gold. The long term setup in TIP seems to be hitting a multi-decade low in the context of its rising channel. It has been used for many centuries to create coins and jewellery. Join thousands of traders and trade CFDs on forex , shares , indices , commodities , and cryptocurrencies! Comment added on February 12th, : The silver CoT report remains very bullish, from an historical perspective. As many analysts point out, silver has been known to outperform its sister metal gold during times of economic prosperity and expansion. Neumeyer has previously stated that he expects a triple-digit silver price in part because he believed the market cycle could be compared to the year , when investors were sailing high on the dot-com bubble and the mining sector was down. Analysts forecast that the price of gold and silver will rise if the Federal Reserve cuts interest rates this year, according to a report from CNBC Sunday. Controlled Thermal Resources. We pride ourselves not only being the first one to publish a silver price prediction but also do it in a very diligent way, backed by thorough research. March 10,

It is simply matchless theme :)

You are not right. I am assured. I can prove it. Write to me in PM.

Very useful phrase