Swing trading screener

Understanding the Importance of Stock Screeners. Key Features to Look for in a Stock Screener.

A stock screener narrows thousands of stocks down to a manageable handful. This is how pro traders find promising stocks and build strong watchlists. Swing traders can take weeks or months to let a move play out. In swing trading, you get more time to think about your process and research stocks. Taking too much time to research might mean missing out on great trading opportunities. Why do you need a stock screener for swing trading, and which ones are the best?

Swing trading screener

.

With the right tools and strategies in place, swing trading can become a profitable endeavor.

.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Swing trading screener

A stock screener narrows thousands of stocks down to a manageable handful. This is how pro traders find promising stocks and build strong watchlists. Swing traders can take weeks or months to let a move play out. In swing trading, you get more time to think about your process and research stocks.

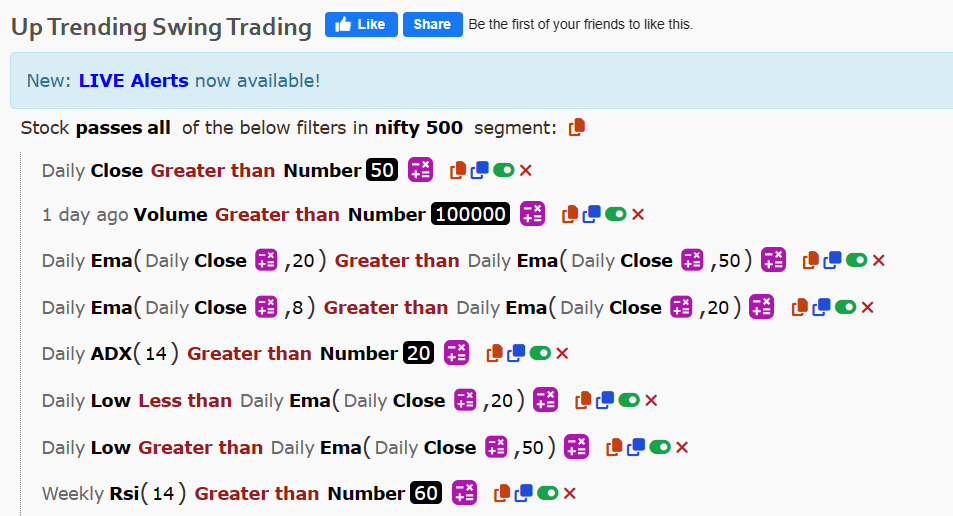

Gartic phone

In this section, we will explore how to effectively use a stock screener to identify potential swing trading setups. A customizable filter system, real-time data, technical analysis tools, backtesting capabilities, and a user-friendly interface are all crucial elements that can significantly improve your swing trading success. At the end of each trading day, Holly looks over everything that happened and comes up with multiple strategies to help traders beat the market. Analyzing Technical Indicators with a Stock Screener 8. For swing traders seeking advanced scanning capabilities and real-time alerts, Trade Ideas is a top contender. Another valuable feature of a stock screener is the ability to review historical performance. For swing trading, some common criteria include price range, volume, and average daily range. For instance, if you are interested in investing in the technology sector, you can use the screener to filter for technology stocks and compare their fundamental and technical characteristics. With Finviz, swing traders can filter stocks based on various criteria such as market capitalization, volume, price, and technical indicators. The screener also allows users to create custom filters and save them for future use. Performance measurement is a critical aspect of determining the efficiency of Return on While swing trading is primarily driven by technical analysis, considering fundamental factors can provide additional insights and enhance your trading strategy. A stock screener can help swing traders identify stocks that exhibit specific technical patterns or have specific indicator values. What you can do is recreate the screen and tweak it according to your needs. Look for a screener that allows you to input your strategy parameters and test them against historical data to see how your trades would have performed in the past.

In the ever-evolving world of swing trading, the quest for the next big opportunity can be as challenging as it is thrilling. Amidst a sea of stocks, identifying those poised for significant moves often feels like searching for a needle in a haystack.

With thinkorswim, swing traders can filter stocks based on various criteria, including technical indicators, fundamental data, and market trends. Swing Trading Strategies. They have evolved over time, Will Alpha Scanner give you an edge in trading? These tools can help you identify trends, patterns, and potential entry or exit points for your swing trades. Furthermore, Finviz provides real-time stock quotes, charts, and news, enabling swing traders to stay up-to-date with the latest market trends. Additionally, real-time data and the ability to save and track your scans over time are important features to consider. Introduction to Swing Trading 2. Furthermore, thinkorswim offers a paper trading feature, allowing swing traders to test their strategies without risking real money. Some popular indicators for swing trading include moving averages, relative strength index RSI , and Bollinger Bands. In swing trading, identifying catalysts that can drive stock prices in the short term is crucial. Look for a stock screener that offers an intuitive and easy-to-use interface, with clear and concise instructions. By understanding the impact of these events on a company's financials and market sentiment, swing traders can make more informed trading decisions.

0 thoughts on “Swing trading screener”