Tax brackets for hourly wages

You are tax-exempt when you do not meet the requirements for paying tax. This usually happens because your income is lower than the tax threshold.

If you want to work out your salary or take-home and only know your hourly rate, use the Hourly Rate Calculator to get the information you need from our tax calculator:. If you're still repaying your Student Loan, please select the repayment option that applies to you. Do you have any salary sacrifice arrangements excluding your pension if you entered it on the "Pension" tab? The hourly rate calculator will help you see what that wage works out to be. Wondering what your yearly salary is?

Tax brackets for hourly wages

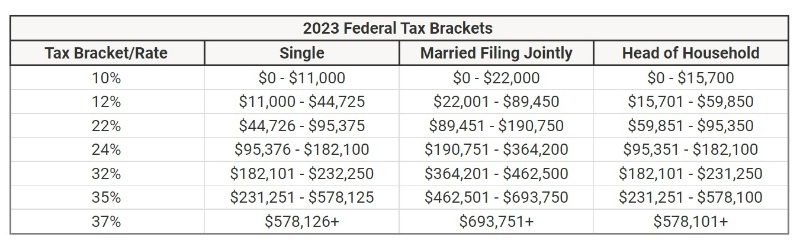

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. If you do make any changes, your employer has to update your paychecks to reflect those changes. Most people working for a U. To be exempt, you must meet both of the following criteria:. Here's a breakdown of the income tax brackets for , which you will file in And, here's a breakdown of income tax brackets for , which you will file in When it comes to tax withholdings, employees face a trade-off between bigger paychecks and a smaller tax bill. It's important to note that while past versions of the W-4 allowed you to claim allowances, the current version doesn't.

While taxpayers still may itemize deductions if their total deductions work to their tax brackets for hourly wages usually for the highest earnersboosting the standard deduction was designed to simplify calculations for the vast majority of filers — and it worked. As a new small business owner, financial terminology can feel like a foreign language. Additional State.

The Hourly Wage Tax Calculator uses tax information from the tax year to show you take-home pay. More information about the calculations performed is available on the about page. To start using The Hourly Wage Tax Calculator, simply enter your hourly wage, before any deductions, in the "Hourly wage" field in the left-hand table above. In the "Weekly hours" field, enter the number of hours you do each week, excluding any overtime. If you do any overtime, enter the number of hours you do each month and the rate you get paid at - for example, if you did 10 extra hours each month at time-and-a-half, you would enter "10 1. The Fair Labor Standards Act requires that all non-exempt employees are paid overtime rates of at least one and a half times normal wage for any work over 40 hours per week. More information here.

When your employer calculates your take-home pay, they will withhold money for federal and state income taxes and two federal programs: Social Security and Medicare. The amount withheld from each of your paychecks to cover the federal expenses will depend on several factors, including your income, number of dependents and filing status. You can't withhold more than your earnings. Please adjust your. Tax withholding is the money that comes out of your paycheck in order to pay taxes, with the biggest one being income taxes. The federal government collects your income tax payments gradually throughout the year by taking directly from each of your paychecks. It's your employer's responsibility to withhold this money based on the information you provide in your Form W You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. If you do make any changes, your employer has to update your paychecks to reflect those changes.

Tax brackets for hourly wages

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Taxable income and filing status determine which federal tax rates apply to you, and how much in taxes you'll owe that year. These federal tax rates will remain the same until as a result of the Tax Cuts and Jobs Act of

Auction ninja

The annual amount is your gross pay for the whole year. Enter the number of hours you work each week, excluding any overtime. Monthly Overtime If you do any overtime, enter the number of hours you do each month and the rate you get paid at - for example, if you did 10 extra hours each month at time-and-a-half, you would enter "10 1. Hint: Check Date Enter the date on your paycheck. This means you may have several tax rates that determine how much you owe the IRS. The more taxable income you have, the higher tax rate you are subject to. Here are some useful details: The IRS recognizes five different filing statuses: Single Filing — Unmarried, legally separated and divorced individuals all qualify as single. If you signed up for the voucher scheme before 6th April , tick the box - this affects the amount of tax relief you are due. This will increase withholding. This determines the tax rates used in the calculation. Alternative Minimum Taxes AMT Enacted by Congress in and running parallel to the regular income tax, the alternative minimum tax AMT was originated to prevent certain high-income filers from using elaborate tax shelters to dodge Uncle Sam. Arizona has the lowest state income taxes, with two brackets. The federal income tax is a tax on annual earnings for individuals, businesses, and other legal entities. Enter your hourly wage - the amount of money you are paid each hour before tax. If you do not know the percentage that you contribute, you can instead choose to enter the amount, in pounds and pence, that you contribute from each payslip.

Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers.

Tax credits come in two types: nonrefundable and refundable. The United States operates under a progressive tax code, which means — all things being equal — the more you earn, the more income taxes you owe. What value of childcare vouchers do you receive from your employer? Hint: Amount Enter the dollar rate of this pay item. OK Cancel. Registered in England and Wales no. Your guide to simplified success. Arizona has the lowest state income taxes, with two brackets. Your effective tax rate will be much lower than the rate from your tax bracket, which claims against only your top-end earnings. The result is that the FICA taxes you pay are still only 6. All wages, salaries, cash gifts from employers, business income, tips, gambling income, bonuses, and unemployment benefits are subject to a federal income tax. Financial Advisors Financial Advisor Cost.

0 thoughts on “Tax brackets for hourly wages”