Turbotax tesla credit

I file taxes as single person. Tesla electric vehicles are not eligible for the EV credit due to the Manufacturer sales cap met. The EV credit is non refundable which means if you do not have a tax liability, you cannot claim the credit. Also, the credit for the Tesla has been phased out so it is turbotax tesla credit longer eligible for the credit.

The Inflation Reduction Act of expanded and changed the rules for electric vehicles purchased beginning in through and created the renamed Clean Vehicle Credit. The difference is there are now income, manufacturer sales price, and final assembly requirements that were not in place before. Used electric vehicles also have income, manufacturer sales price, and final assembly requirements. The Inflation Reduction Act of was a shift in practice, especially for vehicles purchased between and Wondering if your vehicle makes the cut for the EV tax credit?

Turbotax tesla credit

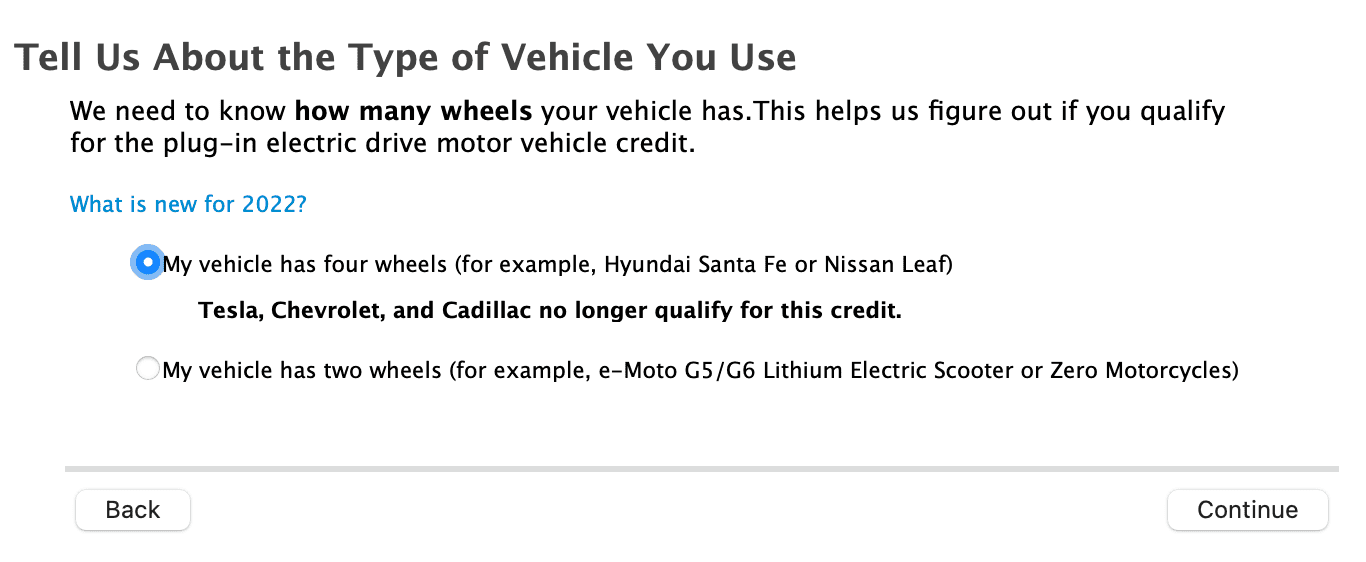

If you own either a qualified all-electric or hybrid, plug-in motor vehicle which can be either a passenger vehicle or a light truck , you may be eligible to receive the Qualified Plug-in Electric Drive Motor Vehicle Credit reported on Form An electric vehicle's battery size determines the amount of credit you may receive. Typically, the larger the battery, the larger the credit. The IRS uses the following equation to determine the amount of credit:. Vehicles will have to meet all of the criteria listed above, plus meet new critical mineral and battery component requirements for a credit up to:. MSRP is the retail price of the automobile suggested by the manufacturer, including manufacturer installed options, accessories and trim but excluding destination fees. It isn't necessarily the price you pay. In accordance with proposed IRS regulations , beginning January 1, , buyers can reduce the clean vehicle's upfront purchase price by the amount of their Clean Vehicle Credit by choosing to transfer their credit to the dealer. For up-to-date information for dealers and consumers on the transfer of tax credits at the point-of-sale, refer to information on the IRS Clean Vehicle Tax Credit. Already have an account? Sign In. TurboTax Help Intuit. What is an electric car tax credit? Qualifying conditions An electric vehicle's battery size determines the amount of credit you may receive.

Employee Tax Expert. TurboTax security and fraud protection.

Theodor Vasile, Unsplash theodorrr. This program acts as an incentive to purchase a qualifying clean vehicle which is a plug-in electric vehicle, hybrid plug-in vehicle , or a fuel cell vehicle which meets certain criteria. Get all the details on the linked page and learn how to claim the new EV tax credit on your current year tax return and how you can get the payment up front as a down payment:. For previous year returns, there is also the Alternative Motor Vehicle Tax Credit which can be claimed for fuel cell vehicles. Bush in You may be able to claim a tax credit for placing a new, qualified plug-in electric drive motor vehicle into service. This is a vehicle that, under IRS Section 30D, weighs less than 14, pounds, runs significantly by an electric motor, draws electricity from a battery that holds at least 5 kilowatt hours, and is capable of being recharged from an external source of electricity.

The electric vehicle tax credit, now called the clean vehicle credit, was recently expanded and modified. Learn about the new rules and restrictions to qualify. The trajectory of climate change was in the crosshairs of the Inflation Reduction Act of , with the US government aiming to lessen the impact seen on the environment. One major culprit of greenhouse gas emissions comes from the transportation sector, gasoline-powered automobile transportation in particular. As a way to lure taxpayers away from internal combustion gas vehicles, the tax code offered a generous incentive to car buyers interested in purchasing an electric vehicle for the first time. The only change made to the credit for tax year is a new North American final assembly requirement, effective August 17, The newly modified credit, now called the clean vehicle credit, has new rules for claiming the credit based on assembly location, income thresholds, and expanded eligibility for the vehicles covered by the credit. These new rules largely take effect in and last until

Turbotax tesla credit

The credit, available to both individuals and businesses, is only eligible for vehicles you buy for your own use not for resale and are used primarily in the United States. Because of the Inflation Reduction Act of , the credit is replaced by the Clean Vehicle Credit for vehicles purchased after Further, certain final assembly requirements were added for vehicles purchased after August 16, That means if you bought and took delivery of a qualified electric vehicle beginning August 17, through December 31, , the same rules applied but the vehicle needed to undergo final assembly in North America. The Department of Energy maintains a database for you to assess whether your model meets these assembly requirements. Some electric vehicles are assembled in multiple locations.

Obits brantford expositor

Easily calculate your tax rate to make smart financial decisions. TurboTax Advantage. You drive the vehicle primarily in the United States. Certain complicated tax situations will require an additional fee, and some will not qualify for the Full Service offering. Beginning in , you can opt for transferring the clean vehicle credit directly to an automotive dealer instead of waiting to claim it on your tax return the next year. Bush in For vehicles purchased after August 16, , only vehicles for which final assembly occurred in North America qualify. In-person meetings with local Pros are available on a limited basis in some locations, but not available in all States or locations. TurboTax Live tax expert products. TurboTax Super Bowl commercial.

Do you qualify for the electric car tax credit?

For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to file or purchase add-on products or services. Crypto Calculator Estimate capital gains, losses, and taxes for cryptocurrency sales Get started. Tax Bracket Calculator Easily calculate your tax rate to make smart financial decisions Get started. Guide to head of household. Professional accounting software. A Form return with limited credits is one that's filed using IRS Form only with the exception of the specific covered situations described below. So I see that Teslas are eligible for the new ev tax credit starting The manufacturer should be able to provide a copy of the certification letter from the IRS. Get your max refund Search over tax deductions and find every dollar you deserve, guaranteed , with TurboTax Deluxe. Self-Employed Tax Calculator Estimate your self-employment tax and eliminate any surprises Get started. Small business taxes. You will still pay any applicable sales taxes and licensing fees at the full non-credit-adjusted purchase price. Crypto tax calculator. Energy Tax Credits.

Actually. Prompt, where I can find more information on this question?

Bravo, what necessary phrase..., a magnificent idea

Your idea simply excellent