Ben felix model portfolio

He is widely recognized for his expertise in the field of investing and financial management and has created a model portfolio, the Ben Felix Model Portfolio.

As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Hey guys! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice.

Ben felix model portfolio

I'm a huge fan of Ben Felix and his proposed factor tilts. Here we'll look at how to construct a U. Interested in more Lazy Portfolios? See the full list here. Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here. Admittedly, he's been a major influence for my content. Felix is a proponent of objectively looking at the evidence and data to inform and optimize investing decisions.

Because the interest rates determine the value of stocks.

.

As a teaser, the ETF model portfolios are a combination of low cost Canadian, US, International Developed and Emerging market-cap weighted equities , a dip-your-toes sprinkling of small-cap value funds and Canadian aggregate bonds. Hey guys! This investing opinion blog post is entirely for entertainment purposes only. There could be considerable errors in the data I gathered. This is not financial advice. Do your own due diligence and research. Consult with a financial advisor.

Ben felix model portfolio

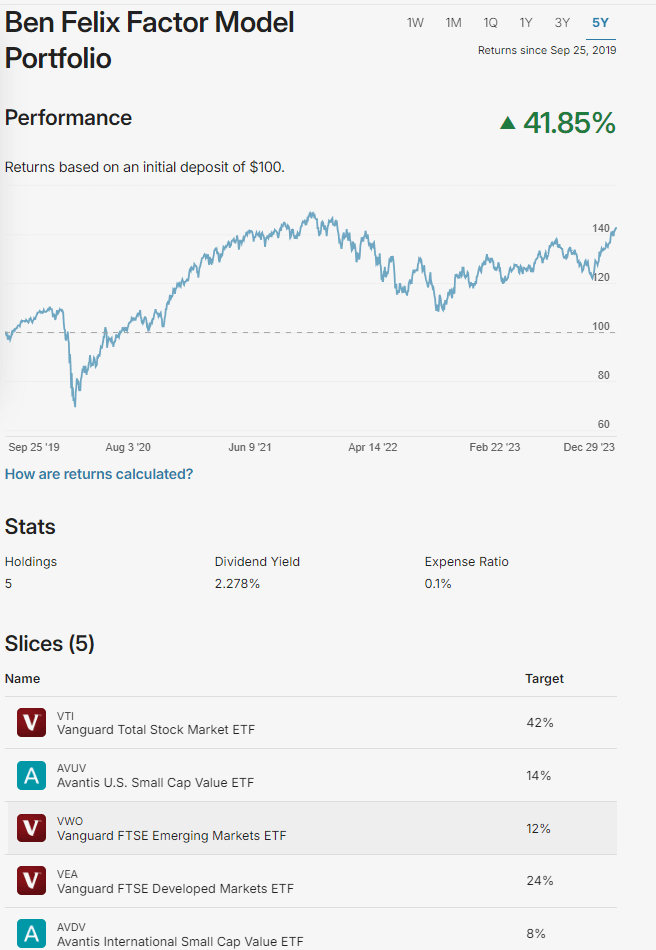

He is widely recognized for his expertise in the field of investing and financial management and has created a model portfolio, the Ben Felix Model Portfolio. In this post, we take a look at Ben Felix Model Portfolio. We end the article with a backtest of the strategy as a matter of fact, we make several backtests. The Ben Felix Model Portfolio is a globally diversified investment strategy that utilizes index funds and tilts towards specific factors, such as size, value, and profitability factor investing. The portfolio is designed to provide investors with a diversified investment strategy that is based on academic research and data analysis. It comprises several different asset classes, including domestic and international stocks, and sometimes, bonds. But it is achieved using index funds. It is diversified across different sectors, geographies, and market capitalizations.

50 warner avenue ashburton

Interested in more Lazy Portfolios? We'll assume you're ok with this, but you can opt-out if you wish. Felix is a proponent of objectively looking at the evidence and data to inform and optimize investing decisions. I co-founded Aksjeforum. These cookies will be stored in your browser only with your consent. You do not need to pick individual stocks, bonds, REITs,…. He is widely recognized for his expertise in the field of investing and financial management and has created a model portfolio, the Ben Felix Model Portfolio. We make the following weightings into five different Canadian ETFs:. That seems sensible to me since the value factor is significantly more impactful with small caps. Some investors have reported positive results using the strategy, while others criticize it for lacking a….

Their advice at its core is to follow an evidence-based investing approach that starts and usually ends with a low cost, globally diversified, and risk appropriate portfolio of index funds or ETFs. Simplify this even further by investing in a single asset allocation ETF that automatically rebalances itself.

Don't want to do all this investing stuff yourself or feel overwhelmed? I mention M1 Finance a lot around here. These cookies do not store any personal information. Non-necessary Non-necessary. Investment products discussed ETFs, mutual funds, etc. Definitely not. Aggregate Bond ETF. The diversification strategies employed in this portfolio are crucial to minimize risk and optimize returns over time. By using the data from the Fama-French 5 Factor Model, the portfolio aims to improve expected returns by diversifying across not just geographic regions but also different risk factors. Thank you. Are you nearing or in retirement? Another strategy used in this portfolio is the use of low-cost ETFs, which allows the portfolio to be managed efficiently, with low expenses and high liquidity. The Ben Felix Model Portfolio is a globally diversified investment strategy that utilizes index funds and tilts towards specific factors, such as size, value, and profitability factor investing. Risk management techniques include diversification, regular rebalancing, factor tilts, and the use of low-cost index funds and ETFs.

0 thoughts on “Ben felix model portfolio”