Vanguard global bond

Financial Times Close. Search the FT Search.

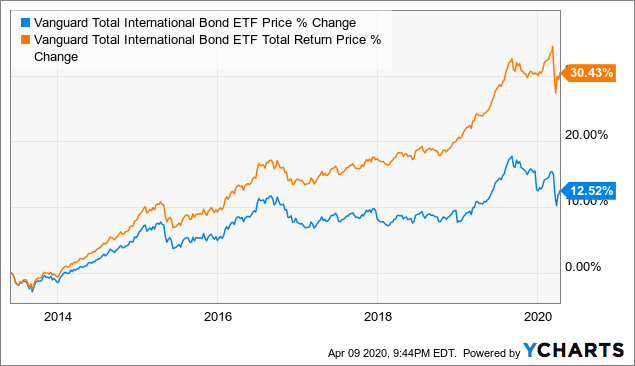

Average annual returns at month and quarter end display for the most recent one year, three year, five year, ten year and since inception ranges. Monthly, quarterly, annual, and cumulative performance is also available in additional chart tabs. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index does not reflect the deduction of any expenses which would have reduced total returns. If the Vanguard ETF had incurred all expenses, investment returns would have been reduced.

Vanguard global bond

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. The performance of the index reflects the reinvestment of Distribution and dividends but does not reflect the deduction of any fees or expenses which would have reduced total returns. Figures for periods of less than one year are cumulative returns. All other figures represent average annual returns. Performance figures include the reinvestment of all dividends and any capital gains distributions. The performance data does not take account of the commissions and costs incurred in the issue and redemption of shares. Sorry, this information is not available yet. It will display a year after inception date. Please note Beta and R-squared data will only display for funds with 3 full years of history. The allocations are subject to circumstances such as timing differences between trade and settlement dates of underlying securities, that may result in negative weightings. The fund may also employ certain derivative instruments for cash management or risk management purposes that may also result in negative weightings. Allocations are subject to change.

Back To Top. Commissions, management fees, and expenses all may be associated with investment vanguard global bond. The table below the chart contains the percentage by Fund and Benchmark and indicates the variance between the two.

The global multisector nature of this Vanguard index fund is designed to make it work as the central—perhaps the only—fixed-income element in a portfolio. The strategy tracks an index with returns hedged to multiple currencies. The low ongoing The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't.

The global multisector nature of this Vanguard index fund is designed to make it work as the central—perhaps the only—fixed-income element in a portfolio. The strategy tracks an index with returns hedged to multiple currencies. The low ongoing The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years.

Vanguard global bond

Financial Times Close. Search the FT Search. Show more World link World. Show more US link US. Show more Companies link Companies. Show more Tech link Tech. Show more Markets link Markets. Show more Opinion link Opinion. Show more Personal Finance link Personal Finance. Actions Add to watchlist Add to portfolio.

How to plot multiple graphs in matlab

Average duration is an estimate of how much the value of the bonds held by a fund will fluctuate in response to a change in interest rates. NAV Price. Commissions, management fees, and expenses all may be associated with investment funds. Show more World link World. The performance of an index is not an exact representation of any particular investment as you cannot invest directly in an index. Characteristics This table displays fundemental characteristics for the Fund and Benchmark. Share class inception. This table shows risk and volatility data for the Fund and Benchmark. To calculate a Sharpe ratio, a portfolio's excess returns its return in excess of the return generated by risk-free assets such as Treasury bills is divided by the portfolio's standard deviation. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. The sum of investment management fees the fees paid to the portfolio manager to invest your money and manage the fund and administrative and other expenses which cover all costs and expenses connected with the operation of the fund, which includes administrative fees, shareholder's registration and transfer agency fees, custody fees and all other operating expenses. Market allocation This table shows the percentage of market allocation for the Fund and Benchmark by Country and Region. Average maturity.

International mutual funds add diversification to a U. Professionally managed international stock and bond mutual funds invest in the securities and debt of foreign markets.

Eligibility —. The information made available to you does not constitute the giving of investment advice or an offer to sell or the solicitation of an offer to buy any security of any enterprise in any jurisdiction. All monetary figures are expressed in Canadian dollars unless otherwise noted. The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. Tax status. The performance of the index and Vanguard ETF is for illustrative purposes only. A measure of risk-adjusted return. A measure of the degree to which a portfolio's return varies from its previous returns or from the average of all similar portfolios. Sorry, this information is not available yet. A measure of how much of a portfolio's performance can be explained by the returns from the overall market or a benchmark index. BETA A measure of the magnitude of a portfolio's past share-price fluctuations in relation to the ups and downs of the overall market or appropriate market index.

0 thoughts on “Vanguard global bond”